Trump trial live updates as first witness returns today

Follow live updates as former President Donald Trump's criminal trial resumes in New York.

Watch CBS News

Follow live updates as former President Donald Trump's criminal trial resumes in New York.

Over 100 victims of Larry Nassar, who was convicted of sexual abuse and child pornography, will receive a settlement from the Justice Department.

Antisemitic chants and even threats against Jewish students have brought the tension of the Middle East onto U.S. college campuses.

Scammers have been increasingly successful in leveraging their romantic grip on victims by turning them into unwitting co-conspirators, or "money mules."

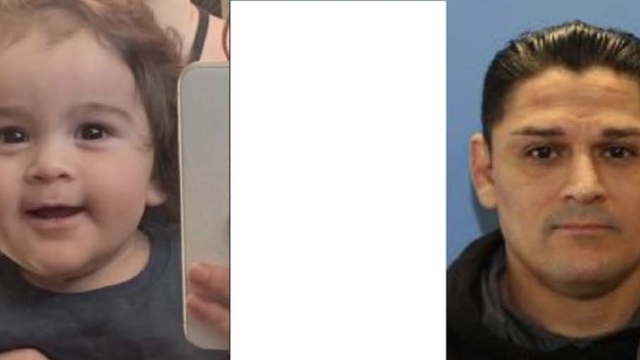

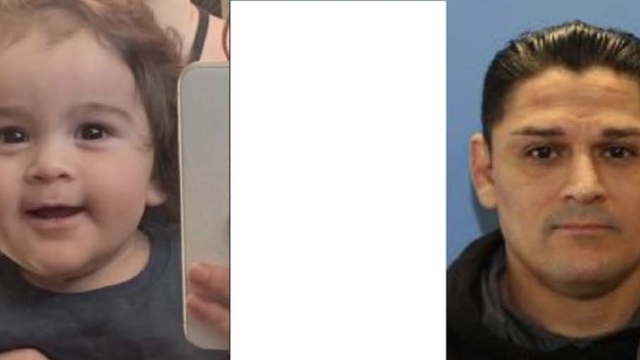

Authorities in Washington state are searching for a former officer accused of killing two women and abducting a child.

Former President Donald Trump could receive a large windfall from his newly public media company, Trump Media & Technology Group.

The Senate is expected to approve the foreign aid package this week after months of disagreement in Congress.

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

The photo of Prince Louis is said to have been taken by his mother Catherine, Princess of Wales.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

The wreck is "partly disintegrated," but some remnants have been "very well preserved."

In November 2023, NASA's Voyager 1 spacecraft stopped sending "readable science and engineering data."

In his final letter before he vanished on Mount Everest, George Mallory said his chances of reaching the world's highest peak were "50 to 1 against us."

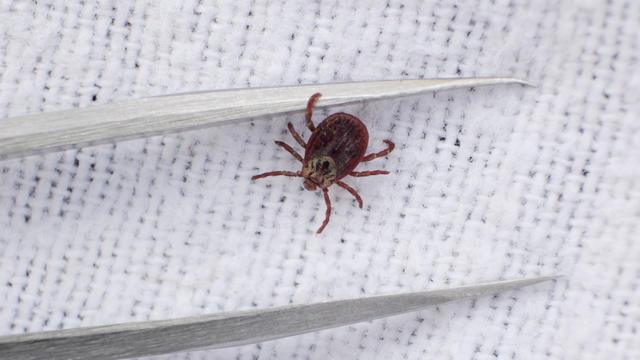

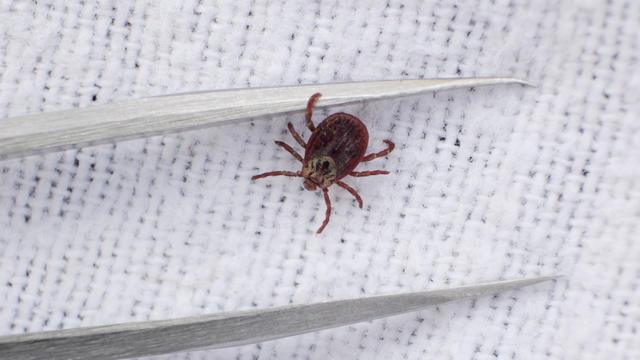

Warmer weather is prime time for ticks that can carry Lyme disease and other illnesses. Here's how to spot them and get rid of them.

The decision came after jurors failed to reach a unanimous decision after more than two full days of deliberation.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

Tires emit huge volumes of particles and chemicals as they roll along the highway, and researchers are only beginning to understand the threat. One byproduct of tire use, 6PPD-q, is in regulators' crosshairs after it was found to be killing fish.

Eric Church is revered as one of country music's most respected figures, often described as Nashville's renegade. But he admits that even after his success, he sometimes still sees himself as an outsider.

Trump made 10 social media posts that were "threatening, inflammatory," prosecutors said, arguing he should pay a fine for each post.

Jurors in former President Donald Trump's criminal trial in New York got their first glimpse of the arguments both sides plan to make.

The case against former President Donald Trump stems from a "hush money" payment of $130,000 to adult film star Stormy Daniels in 2016.

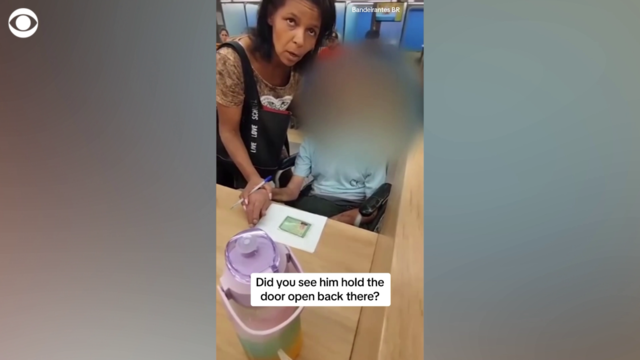

Scammers have been increasingly successful in leveraging their romantic grip on victims by turning them into unwitting co-conspirators, or "money mules."

Laura Kowal's match on an online dating site wasn't what he seemed. Now her daughter is on a mission to expose the risk of romance scams: "It could happen to anybody."

Officials say the story of a woman found dead, her savings drained, after meeting a con artist on an online dating site is part of a national crisis unfolding largely in secret.

The RNC announced an ambitious initiative to monitor vote processing in the 2024 presidential election.

This appears to mean only a pro-abortion rights measure may qualify for the Colorado ballot this fall.

They backed the president even as their brother makes his own bid for Biden's job.

Protesters have been arrested at Columbia and Yale as they've refused to move, calling for a break from Israel.

A tiny baby rescued from the womb after an Israeli airstrike in Gaza killed her mother is doing well.

The strike hit a residential building in the western Tel Sultan neighborhood, according to Gaza's civil defense.

A mortgage loan denial is disheartening, but there are ways to improve your chances of future approval.

If you're looking for ways to resolve your overwhelming credit card debt, these strategies are worth considering.

Long-term care insurance doesn't just cover nursing homes. Here are six other things it can cover.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

Cancer, heart disease, respiratory illnesses and kidney dysfunction among the health consequences of a warming planet.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

UAW claims historic victory, with an overwhelming majority of VW workers at Chattanooga factory voting to unionize.

Receive a $40 Digital Costco Shop Card when you join as a new member at Costco.com when entering PARA24 at checkout.

Memorial Day weekend isn't here yet, but you can still score massive discounts on the best mattresses of 2024 now.

Give your grad a thoughtful gift that can help them prepare for life after high school and beyond.

A yearlong CBS News investigation explores a troubling new twist on romance scams that challenges investigators. The victims, often blinded by love, are being turned into unwitting co-conspirators.

CBS News legal analyst Rikki Klieman discusses the first day of the Trump trial and what to expect as testimony continues.

For more than two months, Israel has threatened to send troops into Rafah, despite the U.S. advising against the operation. However, even without the possible ground assault, the southern Gaza city experiences daily attacks.

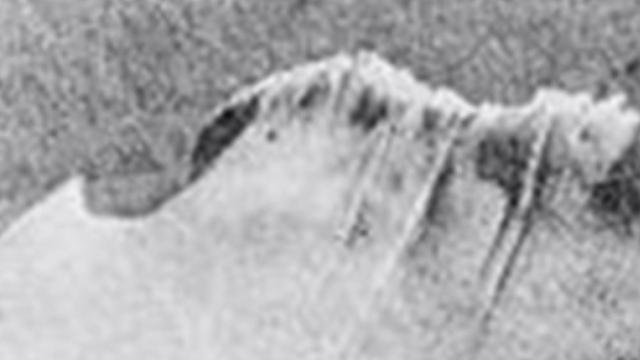

A photo taken two days after the sinking of the RMS Titanic apparently shows the iceberg that doomed the so-called unsinkable ship in 1912. CBS News' John Dickerson has details.

Author Nicholas Sparks and the members of the creative team of “The Notebook” sit down with David Pogue to discuss the development of the famous novel into a Broadway musical. Then, Lee Cowan visits Vashon Island, Washington, to meet Thomas Dambo, the creator of wooden trolls. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Actor Marcia Gay Harden sits down with Seth Doane to discuss her CBS series "So Help Me Todd," her LGBTQ+ activism and her love of pottery. Then, Jonathan Vigliotti meets Julian Curi, the filmmaker behind the short film "Gruff." "Here Comes the Sun" is a closer look at some of the people, places and things we bring you every week on "CBS Sunday Morning."

Comedian and actor Kevin James sits down with Jim Axelrod to discuss his Amazon Prime special "Kevin James: Irregardless,” and the journey he has taken throughout his career. Then, Robert Costa visits the National Gallery of Art in Washington, D.C., to view an exhibit on artist Mark Rothko’s work. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Actor Paul Giamatti sits down with Lesley Stahl to discuss his latest film, “The Holdovers,” as well as other characters he has portrayed throughout his career. Then, Seth Doane travels to the Musée d’Orsay in Paris to learn about the AI-generated avatar of Vincent Van Gogh. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Actor Hilary Swank sits down with Tracy Smith to discuss her latest film, “Ordinary Angels.” Then, Conor Knighton travels to New Orleans to meet portraitist Michael Deas and to learn about his paintings found on stamps, Time magazine covers and more. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

Emmy and Tony Award-winning actress Bebe Neuwirth is back on Broadway, starring as Fraulein Schneider in the new revival of "Cabaret."

Chanel Miller, celebrated for her profound memoir "Know My Name," steps into a new creative realm with her children's book, "Magnolia Wu Unfolds It All." The story, both written and illustrated by Miller, follows two young friends on an adventurous quest through New York City to return misplaced socks from Magnolia's parents' laundromat.

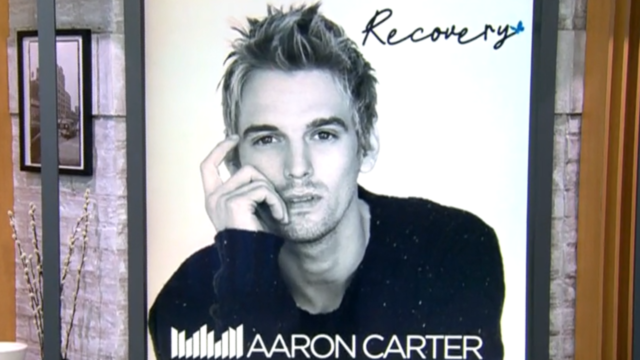

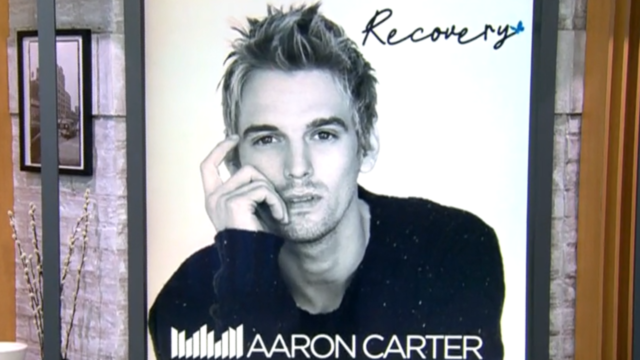

First on "CBS Mornings," we're getting a first listen to a never-before-heard song from Aaron Carter. Carter died in 2022 after struggling with addiction and mental health issues. Now, his team and his sister, Angel Carter Conrad, are releasing his previously unheard music. "The Recovery Album" comes out May 24. Part of the proceeds will go to the nonprofit "The Kids Mental Health Foundation," formerly known as "On Our Sleeves."

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

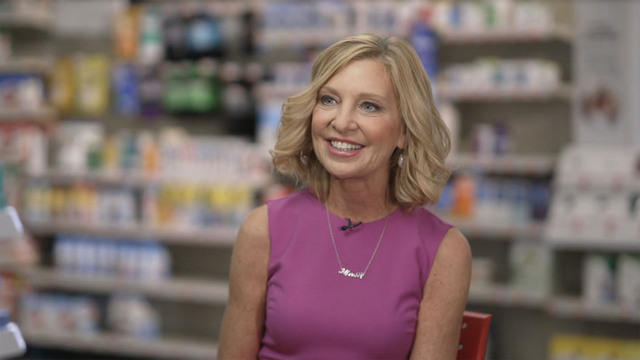

In this episode of "Person to Person with Norah O’Donnell," O’Donnell speaks with CVS Health CEO and author Karen Lynch about her life and career.

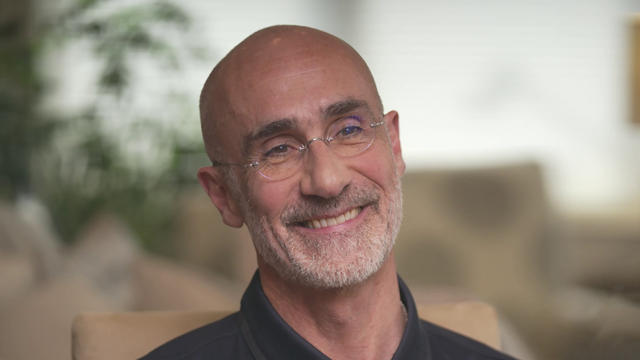

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with author and professor Adam Grant about his newest book, as he discusses unlocking your hidden potential.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with author and professor Arthur Brooks about his partnership with Oprah Winfrey and the key to living a happier life.

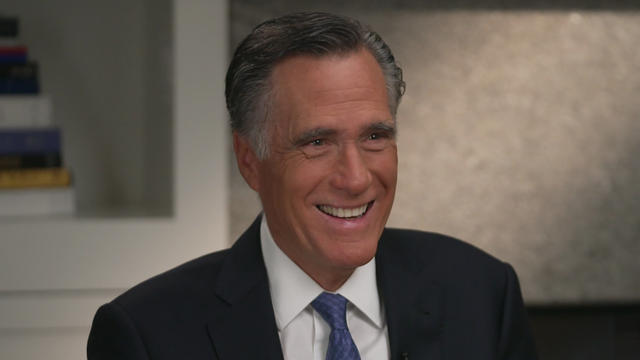

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with Senator Mitt Romney about his place in the Republican party, his family’s influence and what’s next for him in politics.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with Dolly Parton about her new book on her costumes and clothing and her new rock album.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

A surfing accident left New York teacher Billy Keenan paralyzed, but when he received a call from a police officer, his life changed.

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

A mom was worried about what her son, who has autism, would do after high school. So she opened the So Much To Give cafe, a restaurant in Cedars, Pennsylvania, that employs people with disabilities – and helps them grow.

A mom worried about her son with autism opens an inclusive cafe that employs people with disabilities. The community around Paradise, California, rallies behind a woman whose beloved pet was stolen. Plus, more heartwarming stories.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

Follow live updates as former President Donald Trump's criminal trial resumes in New York.

Angel Carter Conrad talks about her brother Aaron Carter, his death and how she hopes his legacy and previously unheard music can help others.

Over 100 victims of Larry Nassar, who was convicted of sexual abuse and child pornography, will receive a settlement from the Justice Department.

Trump made 10 social media posts that were "threatening, inflammatory," prosecutors said, arguing he should pay a fine for each post.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Former President Donald Trump could receive a large windfall from his newly public media company, Trump Media & Technology Group.

Proposed deal "threatens to deprive consumers of the competition for affordable handbags," federal agency says.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

Follow live updates as former President Donald Trump's criminal trial resumes in New York.

Trump made 10 social media posts that were "threatening, inflammatory," prosecutors said, arguing he should pay a fine for each post.

The Senate is expected to approve the foreign aid package this week after months of disagreement in Congress.

As of the end of March, more than 187,000 Ukrainians have arrived in the U.S. under the Uniting for Ukraine program, resettling with resounding efficiency and relatively little controversy.

The NYPD made several arrests at a pro-Palestinian protest outside NYU's Stern School of Business in Gould Plaza.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Warmer weather is prime time for ticks that can carry Lyme disease and other illnesses. Here's how to spot them and get rid of them.

Tires emit huge volumes of particles and chemicals as they roll along the highway, and researchers are only beginning to understand the threat. One byproduct of tire use, 6PPD-q, is in regulators' crosshairs after it was found to be killing fish.

Cancer, heart disease, respiratory illnesses and kidney dysfunction among the health consequences of a warming planet.

To reduce recidivism, some rural counties are hiring community health workers or peer support specialists to connect people leaving custody to mental health, substance use treatment, medical services and jobs.

The photo of Prince Louis is said to have been taken by his mother Catherine, Princess of Wales.

The wreck is "partly disintegrated," but some remnants have been "very well preserved."

A new U.K. law means asylum seekers arriving on British shores without prior permission can be deported to East Africa.

In his final letter before he vanished on Mount Everest, George Mallory said his chances of reaching the world's highest peak were "50 to 1 against us."

As of the end of March, more than 187,000 Ukrainians have arrived in the U.S. under the Uniting for Ukraine program, resettling with resounding efficiency and relatively little controversy.

Eric Church is revered as one of country music's most respected figures, often described as Nashville's renegade. But he admits that even after his success, he sometimes still sees himself as an outsider.

Angel Carter Conrad talks about her brother Aaron Carter, his death and how she hopes his legacy and previously unheard music can help others.

Emmy and Tony Award-winning actress Bebe Neuwirth is back on Broadway, starring as Fraulein Schneider in the new revival of "Cabaret."

Chanel Miller, celebrated for her profound memoir "Know My Name," steps into a new creative realm with her children's book, "Magnolia Wu Unfolds It All." The story, both written and illustrated by Miller, follows two young friends on an adventurous quest through New York City to return misplaced socks from Magnolia's parents' laundromat.

Country music star Eric Church has had a standout year, marked by the opening of his new bar, restaurant and venue called “Chief's” in Nashville. In addition to launching this highly-anticipated spot, Church is playing a 19-show residency there.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

Secretary of Commerce Gina Raimondo is at the center of a global competition for semiconductor dominance. It's a battle that also puts her at the center of two of the hottest global national security hotspots. Lesley Stahl of 60 Minutes spoke with Raimondo for the broadcast.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

More than 100 nations, including the United States, have agreed to protect 30% of the world's oceans by 2030.

A photo taken two days after the sinking of the RMS Titanic apparently shows the iceberg that doomed the so-called unsinkable ship in 1912. CBS News' John Dickerson has details.

Despite how terrifying sharks might seem, the creatures are critical to the survival of the world's oceans. Oceans generate 50% of the oxygen on the planet and absorb 90% of excess heat created by global warming. CBS News senior national and environmental correspondent Ben Tracy spoke with conservationists in the Bahamas.

A new CBS poll finds that most of the public favors the U.S. taking steps to address climate change. CBS News executive director of elections and surveys Anthony Salvanto breaks down the numbers.

Climate change could cause a $38 trillion income loss per year globally by 2049, according to a new study by the Potsdam Institute for Climate Impact Research. CBS News' Lilia Luciano breaks down the numbers.

A recent report by the United Nations warned that 1 million species are at risk of extinction because of climate-related issues, and some scientists say the number could be even higher. CBS News national environmental correspondent David Schechter has more.

Over 100 victims of Larry Nassar, who was convicted of sexual abuse and child pornography, will receive a settlement from the Justice Department.

Authorities in Washington state are searching for a former officer accused of killing two women and abducting a child.

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

Scammers have been increasingly successful in leveraging their romantic grip on victims by turning them into unwitting co-conspirators, or "money mules."

Prosecutors objected some of the survey questions about Bryan Kohberger and the deaths of four University of Idaho students.

In November 2023, NASA's Voyager 1 spacecraft stopped sending "readable science and engineering data."

In two weeks, Boeing's Starliner spacecraft is scheduled to launch its first piloted test flight, bringing two veteran NASA astronauts to the International Space Station. Astronaut Matt Dominick joined CBS News from the ISS to talk about the mission and life in space.

A process called cryopreservation allows cells to remain frozen but alive for hundreds of years. For some animal cells, the moon is the closest place that's cold enough.

The Lyrid meteor show is set to peak as the week begins.

April's full moon, known as the Pink Moon, will reach peak illumination on Tuesday, but it will appear full from Monday morning through Thursday morning.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

A 10-foot-long alligator was wrangled and relocated after wandering onto the tarmac at MacDill Air Force Base near Tampa, Florida.

Donald Trump's Tuesday began with a contempt hearing over whether the former president violated a gag order in his ongoing "hush money" trial in New York. CBS News national correspondent Errol Barnett and CBS News legal contributor Jessica Levinson have more on the hearing and the rest of the case.

A Brazilian woman brought a 68-year-old man in a wheelchair into a bank branch and tried to get him to sign for a loan, police said. Bank staff became suspicious and called the police, who said he had been dead for hours. Local media reported that the family's lawyer disputed the account offered by police, saying "the facts did not happen as stated" and that the man had arrived at the bank alive.

The organization that's supposed to keep performance-enhancing drugs out of the Olympics denied Monday that it is soft on China's athletes. But U.S. anti-doping officials don't buy that, especially after an investigation revealed that Chinese swimmers who tested positive for a banned drug were allowed to compete in the Tokyo games in 2021. CBS News senior foreign correspondent Holly Williams has more.

Voters will also be choosing their candidates in Pennsylvania's U.S. Senate race Tuesday as the commonwealth holds its primary contests. Democratic Sen. Bob Casey is seeking his fourth term against two-time Republican Senate challenger David McCormick. CBS News politics reporter Zak Hudak has more.