Supreme Court to consider Trump's sweeping immunity claim in 2020 election case

The justices will convene today to consider whether the former president is entitled to broad immunity from criminal charges in the 2020 election case.

Watch CBS News

The justices will convene today to consider whether the former president is entitled to broad immunity from criminal charges in the 2020 election case.

As Israel's leader equates U.S. university protests to rallies in Nazi Germany, Palestinian students tell CBS News what the support means to them.

Former National Enquirer publisher David Pecker is expected to continue testifying in Donald Trump's New York criminal trial, his third day on the stand.

In an exclusive interview with CBS News' Norah O'Donnell, Pope Francis called for "negotiated peace" in Ukraine and Gaza, noting the devastating effects war has on children.

An Arizona grand jury indicted 18 people in connection with an alleged attempt to use alternate electors after the 2020 election.

CDC's provisional figures show a 2% decline in births from 2022 to 2023.

William Ray Grimes was indicted on charges of murder and burglary in the 2012 slaying of Lowell Badger, police said.

Two sources briefed on the situation told CBS News the agent spouted gibberish, was speaking incoherently and provoked another officer physically.

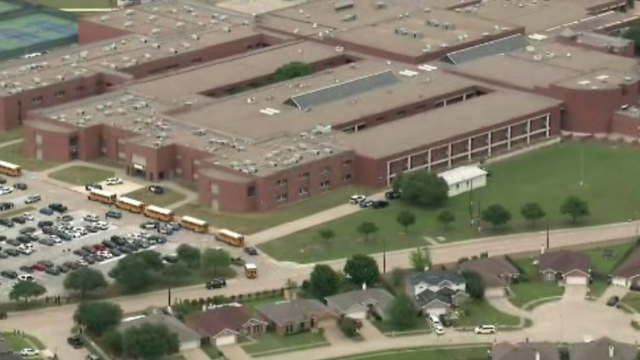

Classes at James Bowie High School were canceled for Thursday.

More than two years after jet fuel leaked into the system supplying water to almost 93,000 people in Hawaii, families impacted are taking the U.S. government to trial.

Taylor Swift fans have found a way to feel "a little bit closer to" their hero at a London watering hole, and The Black Dog pub is lapping it up.

Boston Police arrested more than 100 people as they cleared out pro-Palestinian protesters and their encampment from Emerson College early Thursday morning.

Two-year-old Tyler Fabregas asked his mother "Where's Beyoncé?" in a viral TikTok video she posted last week from Manila.

Egg prices are jumping as an outbreak of highly pathogenic avian influenza forces producers to slaughter millions of infected birds.

The rat hole had been there for several years—some estimate around 20—but gained fame on social media just this year.

Four-year-old Abigail Mor Edan was held by Hamas for 50 days and was the youngest American hostage released by Hamas.

Coal-fired power plants would have to capture smokestack emissions or shut down under a new EPA rule the industry says would make the grid less reliable. It's likely to face court challenges.

Paul Grice, 31, was arrested and charged by Oklahoma authorities with murder and kidnapping in connection to the deaths of Veronica Butler and Jilian Kelley.

There are no cameras allowed in the court where Trump is being tried on 34 felony counts stemming from a "hush money" payment before the 2016 election.

Jurors in former President Donald Trump's trial in New York heard testimony from a former media executive about his efforts to bury negative stories about Trump before the 2016 presidential election.

Trump made 10 social media posts that were "threatening, inflammatory," prosecutors said, arguing he should pay a fine for each post.

The FBI calls on tech companies to "step up" to protect people looking for love online.

Laura Kowal's match on an online dating site wasn't what he seemed. Now her daughter is on a mission to expose the risk of romance scams: "It could happen to anybody."

Scammers have been increasingly successful in leveraging their romantic grip on victims.

Summer Lee has defeated Bhavini Patel in the Democratic primary for Pennsylvania's 12th Congressional District, the Associated Press projects.

He could receive a large windfall from his newly public media company, Trump Media & Technology Group.

Protesters have been arrested at Columbia and Yale as they've called for a break from Israel.

House Speaker Mike Johnson was met with loud boos as he visited Columbia University, where he joined calls for the president's resignation amid pro-Palestinian protests.

Campus Department of Public Safety officers visited the encampment, instructed students not to hang signs, flags or other materials from trees and posts in the park, and warned them not to use megaphones.

The video appears to show U.S.-Israeli hostage Hersh Goldberg-Polin delivering a message under duress.

Delayed rate cuts translate to continued favorable yields on deposit accounts and Treasury bills.

If you're thinking about getting a home equity loan, you may want to do so before May. Here's why.

A debt relief service may be able to help you deal with mounting debt. Here's why now is a great time to sign up.

New Transportation Department rules could save consumers $500 million annually, Transportation Secretary Pete Buttigieg said.

Trump Media CEO Devin Nunes is asking four House committees to investigate possible "naked" short selling in the company's shares.

Travelers often spend more than they need to for airfare, experts say. Here's what to know about paying for add-ons like your seat assignment.

Lawmakers argue the Chinese government can use the widely popular video-sharing app as a spy tool and to covertly influence the U.S. public.

Regulators prohibit new noncompetes, which impede millions of U.S. workers from getting a better job.

Receive a $40 Digital Costco Shop Card when you join as a new member at Costco.com when entering PARA24 at checkout.

These best cooling floor fans from Dyson, Honeywell, Black+Decker and more will cool you in the months ahead.

The best meal kits for weight loss make it easy (and fun!) to stick to a healthy, consistent diet.

Pope Francis called for countries at war to negotiate in an exclusive interview with "CBS Evening News" anchor and managing editor Norah O'Donnell in Rome. "A negotiated peace is better than a war without end," the pontiff said. "Look to negotiate. Look for peace."

"CBS Evening News" anchor and managing editor Norah O'Donnell was given a private tour of the magnificent St. Peter's Basilica, the largest church in the world, located in the smallest nation in the world.

The Supreme Court on Wednesday listened to arguments over whether Idaho's near-total abortion ban violates a federal law that requires hospitals that participate in Medicare to provide necessary stabilizing treatment, including emergency abortion care. Jan Crawford reports.

Arizona's House of Representatives on Wednesday advanced an effort to repeal the state's Civil War-era abortion ban that's set to go into effect June 8. CBS News campaign reporter Shawna Mizelle has the latest from Phoenix.

Deesha Dyer, a former hip-hop journalist and community college student from Philadelphia, shares her inspiring path to becoming the White House social secretary under former President Barack Obama. Her new book, "Undiplomatic: How My Attitude Created the Best Kind of Trouble," details her rise from a 2009 internship to managing state dinners concerts, and high-profile visits, including from the pope.

Country music star Blake Shelton expands his popular bar and music venue 'Ole Red' from Nashville to Las Vegas. This opening coincides with Shelton stepping back from his prominent TV roles.

Between now and 2030, about 10,000 people in the U.S. will turn 65 every single day. Many experts say the country is unprepared to care for them, and that care often falls on their adult children. As Americans have children later in life, many end up taking care of a parent and young kids at the same time. They're referred to as the "sandwich generation." CBS News contributor Lisa Ling understands it personally, and she's diving into this issue.

A warning for Americans traveling to the Caribbean: The territory of Turks and Caicos has enacted strict new laws, with a mandatory minimum prison sentence of 12 years for carrying guns or ammunition. Ryan Watson from Oklahoma is behind bars there and has a bail hearing today. The Oklahoma man was arrested when airport security found bullets in his luggage, which he says he brought by mistake

Dating companies say protecting their customers is a top priority but critics want them to do more to curb online scams and stop bad actors in their tracks, law enforcement officials and online security experts say. CBS News asks the CEO of Match Group — one of the biggest players in the online dating space — about customers who have lost everything.

President Biden and his reelection campaign clearly state they need Latino support this November. However, several polls in recent months have revealed an increasing number of Latino voters preferring former President Donald Trump. CBS News political director Fin Gómez and Democratic strategist Chuck Rocha join to discuss more.

"CBS Evening News" anchor and managing editor Norah O'Donnell was given a private tour of the magnificent St. Peter's Basilica, the largest church in the world, located in the smallest nation in the world.

CBS News asked Catholics in cities across the U.S. about their relationship with the church and how they feel about the pope. Nikki Battiste has more.

In an exclusive interview with CBS News' Norah O'Donnell, Pope Francis called for "negotiated peace" in Ukraine and Gaza, noting the devastating effects war has on children.

Two-year-old Tyler Fabregas asked his mother "Where's Beyoncé?" in a viral TikTok video she posted last week from Manila.

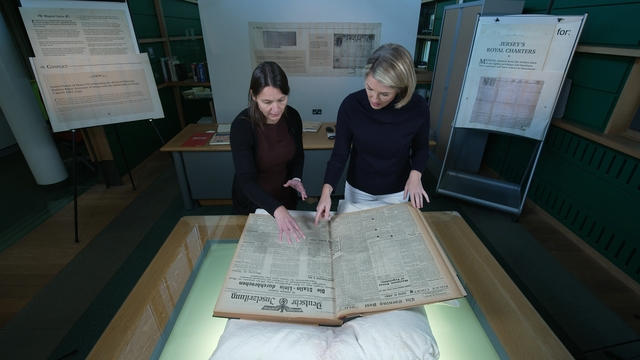

A piece of Holocaust history — a Nazi concentration camp built on Alderney, a British island — has been largely forgotten. Researchers are now counting the island’s dead.

Kevin Hart is the highest-grossing comedian today, while also starring in movies and owning several businesses, including an entertainment company, a venture capital fund and a fast food chain.

Secretary of Commerce Gina Raimondo is focused on U.S. advanced microchip production — and keeping the chips out of China and Russia.

Salman Rushdie has come to terms with the attempt on his life the only way he knows: by writing about it in his new book. He details the experience in his first television interview since the attack.

Thylacines — marsupials known as Tasmanian tigers — were declared extinct decades ago, but efforts to find one in the wild are thriving. Scientists are also working to bring back the species.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

A surfing accident left New York teacher Billy Keenan paralyzed, but when he received a call from a police officer, his life changed.

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

A mom was worried about what her son, who has autism, would do after high school. So she opened the So Much To Give cafe, a restaurant in Cedars, Pennsylvania, that employs people with disabilities – and helps them grow.

David Begnaud visits Jeffrey Olsen, known as the "Toy Man" in Vista, California, who has dedicated over 30 years to donating toys, food, and clothes to those in need.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

More than two years after jet fuel leaked into the system supplying water to almost 93,000 people in Hawaii, families impacted are taking the U.S. government to trial.

As Israel's leader equates U.S. university protests to rallies in Nazi Germany, Palestinian students tell CBS News what the support means to them.

William Ray Grimes was indicted on charges of murder and burglary in the 2012 slaying of Lowell Badger, police said.

The Supreme Court will convene Thursday to consider whether former President Donald Trump is entitled to broad immunity from criminal charges in the 2020 election case.

Former National Enquirer publisher David Pecker is expected to continue testifying in Donald Trump's New York criminal trial, his third day on the stand.

Coal-fired power plants would have to capture smokestack emissions or shut down under a new EPA rule the industry says would make the grid less reliable. It's likely to face court challenges.

Proponents say a sweeping ban on noncompete clauses should boost workers, but the new rules face serious legal challenges.

Egg prices are jumping as an outbreak of highly pathogenic avian influenza forces producers to slaughter millions of infected birds.

New Transportation Department rules could save consumers $500 million annually, Transportation Secretary Pete Buttigieg said.

Niselio Barros Garcia Jr., 50, scammed victims out of $2.3 million in funds, according to authorities.

Coal-fired power plants would have to capture smokestack emissions or shut down under a new EPA rule the industry says would make the grid less reliable. It's likely to face court challenges.

The Supreme Court will convene Thursday to consider whether former President Donald Trump is entitled to broad immunity from criminal charges in the 2020 election case.

Former National Enquirer publisher David Pecker is expected to continue testifying in Donald Trump's New York criminal trial, his third day on the stand.

An Arizona grand jury indicted 18 people in connection with an alleged attempt to use alternate electors after the 2020 election.

Two sources briefed on the situation told CBS News the agent spouted gibberish, was speaking incoherently and provoked another officer physically.

CDC's provisional figures show a 2% decline in births from 2022 to 2023.

Don't brush your teeth after breakfast? Or after vomiting? Dentists say it can wear away your enamel. Here's what to do instead.

Federal officials say they're double checking whether pasteurization has eradicated the danger from possible bird virus particles in milk.

For the first time, surgeons at NYU Langone Health performed a combined mechanical heart pump and gene-edited pig kidney transplant into a living person.

The USDA had floated banning flavored milk options from some school lunches.

Taylor Swift fans have found a way to feel "a little bit closer to" their hero at a London watering hole, and The Black Dog pub is lapping it up.

As Israel's leader equates U.S. university protests to rallies in Nazi Germany, Palestinian students tell CBS News what the support means to them.

In an exclusive interview with CBS News' Norah O'Donnell, Pope Francis called for "negotiated peace" in Ukraine and Gaza, noting the devastating effects war has on children.

Two-year-old Tyler Fabregas asked his mother "Where's Beyoncé?" in a viral TikTok video she posted last week from Manila.

Four-year-old Abigail Mor Edan was held by Hamas for 50 days and was the youngest American hostage released by Hamas.

Taylor Swift fans have found a way to feel "a little bit closer to" their hero at a London watering hole, and The Black Dog pub is lapping it up.

Two-year-old Tyler Fabregas asked his mother "Where's Beyoncé?" in a viral TikTok video she posted last week from Manila.

Country music star Blake Shelton expands his popular bar and music venue 'Ole Red' from Nashville to Las Vegas. This opening coincides with Shelton stepping back from his prominent TV roles.

Surprise guests, a broken foot and a history-making headliner.

Eric Church is revered as one of country music's most respected figures, often described as Nashville's renegade. But he admits that even after his success, he sometimes still sees himself as an outsider.

Lawmakers argue the Chinese government can use the widely popular video-sharing app as a spy tool and to covertly influence the U.S. public.

NASA's Voyager 1, the first spacecraft to travel beyond our solar system, has started sending information back to Earth again after scientists managed to fix the probe from 15 billion miles away.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

Secretary of Commerce Gina Raimondo is at the center of a global competition for semiconductor dominance. It's a battle that also puts her at the center of two of the hottest global national security hotspots. Lesley Stahl of 60 Minutes spoke with Raimondo for the broadcast.

Emerging cicadas are so loud in one South Carolina county that residents are calling the sheriff's office asking why they can hear a "noise in the air that sounds like a siren, or a whine, or a roar." CBS News' John Dickerson has details.

Representatives from across the world are gathering in Ottawa, Canada, to negotiate a potential treaty to limit plastic pollution. CBS News national environmental correspondent David Schechter has the latest on the talks.

"Although to some, the noise is annoying, they pose no danger to humans or pets," the sheriff wrote. "Unfortunately, it is the sounds of nature."

The White House is considering declaring a national climate emergency to unlock federal powers and stifle oil development, according to a Bloomberg report. Meanwhile, the Biden administration is announcing several projects this Earth Week. Columbia University Climate School professor Dr. Melissa Lott joins with analysis.

NASA's Voyager 1, the first spacecraft to travel beyond our solar system, has started sending information back to Earth again after scientists managed to fix the probe from 15 billion miles away.

William Ray Grimes was indicted on charges of murder and burglary in the 2012 slaying of Lowell Badger, police said.

All this week, CBS News has been investigating online romance scams. In this final installment, Jim Axelrod looks at what law enforcement and lawmakers can do -- but also why it's important for the online dating industry to police itself.

Paul Grice, 31, was arrested and charged by Oklahoma authorities with murder and kidnapping in connection to the deaths of Veronica Butler and Jilian Kelley.

Ann Mayers entered AurGroup Credit Union on April 19 and "demanded money while displaying a handgun," police said.

Niselio Barros Garcia Jr., 50, scammed victims out of $2.3 million in funds, according to authorities.

In November 2023, NASA's Voyager 1 spacecraft stopped sending "readable science and engineering data."

In two weeks, Boeing's Starliner spacecraft is scheduled to launch its first piloted test flight, bringing two veteran NASA astronauts to the International Space Station. Astronaut Matt Dominick joined CBS News from the ISS to talk about the mission and life in space.

A process called cryopreservation allows cells to remain frozen but alive for hundreds of years. For some animal cells, the moon is the closest place that's cold enough.

The Lyrid meteor show is set to peak as the week begins.

April's full moon, known as the Pink Moon, will reach peak illumination on Tuesday, but it will appear full from Monday morning through Thursday morning.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

Emerging cicadas are so loud in one South Carolina county that residents are calling the sheriff's office asking why they can hear a "noise in the air that sounds like a siren, or a whine, or a roar." CBS News' John Dickerson has details.

All this week, CBS News has been investigating online romance scams. In this final installment, Jim Axelrod looks at what law enforcement and lawmakers can do -- but also why it's important for the online dating industry to police itself.

When President Biden signed a foreign aid bill Wednesday that includes tens of billions of dollars in assistance to Ukraine, Israel and Taiwan, it was touted as money that would "strengthen our national security and send a message to the world about the power of American leadership." Retired Lt. Gen. H.R. McMaster, former national security adviser, joins CBS News with analysis.

The Transportation Department announced new rules Wednesday requiring airlines to issue automatic cash refunds for flight cancelations or delays, delayed baggage returns and services like Wi-Fi or seat selection that are paid for but not provided. Transportation Secretary Pete Buttigieg joins CBS News to discuss the changes and how airlines are reacting.

American schools are facing layoffs as enrollment falls and pandemic-era aid dries up. CBS News reporter Bo Erickson has the details.