Trump trial hears witness testimony about "catch and kill" scheme

Jurors in Donald Trump's trial in New York heard testimony from a former media executive about his efforts to bury negative stories about Trump before the 2016 presidential election.

Watch CBS News

Jurors in Donald Trump's trial in New York heard testimony from a former media executive about his efforts to bury negative stories about Trump before the 2016 presidential election.

Over 100 victims of Larry Nassar, who was convicted of sexual abuse and child pornography, will receive a settlement from the Justice Department.

Antisemitic chants and even threats against Jewish students have brought the tension of the Middle East onto U.S. college campuses.

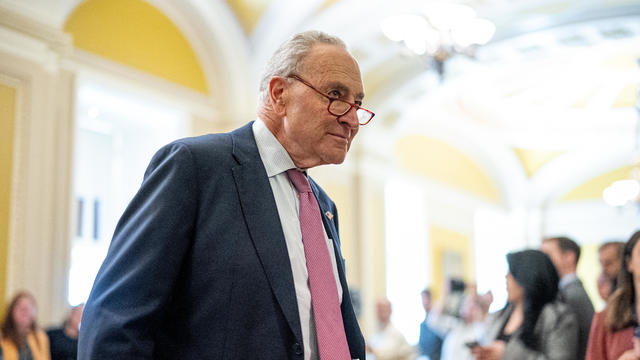

The Senate advanced the foreign aid package, which includes a provision that could lead to a ban on TikTok, after months of disagreement in Congress.

Larry Webb confessed to shooting and killing Susan and Natasha "Alex" Carter, who had been missing for 24 years, officials said.

Former President Donald Trump could receive a large windfall from his newly public media company, Trump Media & Technology Group.

Authorities in Washington state are searching for a former officer accused of killing two women and abducting a child.

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

Surprise guests, a broken foot and a history-making headliner.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

At least 77 students from the women-only college at Cambridge University were recruited to the WWII code breaking station.

The wreck is "partly disintegrated," but some remnants have been "very well preserved."

In November 2023, NASA's Voyager 1 spacecraft stopped sending "readable science and engineering data."

Footage shows wildlife authorities trying to rein in a large alligator that wandered onto MacDill Air Force Base.

Regulators prohibit new noncompetes, which impede millions of U.S. workers from getting a better job.

Warmer weather is prime time for ticks that can carry Lyme disease and other illnesses. Here's how to spot them and get rid of them.

The decision came after jurors failed to reach a unanimous decision after more than two full days of deliberation.

Eric Church is revered as one of country music's most respected figures, often described as Nashville's renegade. But he admits that even after his success, he sometimes still sees himself as an outsider.

Trump made 10 social media posts that were "threatening, inflammatory," prosecutors said, arguing he should pay a fine for each post.

Jurors in former President Donald Trump's criminal trial in New York got their first glimpse of the arguments both sides plan to make.

The case against former President Donald Trump stems from a "hush money" payment of $130,000 to adult film star Stormy Daniels in 2016.

Scammers have been increasingly successful in leveraging their romantic grip on victims by turning them into unwitting co-conspirators, or "money mules."

Laura Kowal's match on an online dating site wasn't what he seemed. Now her daughter is on a mission to expose the risk of romance scams: "It could happen to anybody."

Officials say the story of a woman found dead, her savings drained, after meeting a con artist on an online dating site is part of a national crisis unfolding largely in secret.

The RNC announced an ambitious initiative to monitor vote processing in the 2024 presidential election.

This appears to mean only a pro-abortion rights measure may qualify for the Colorado ballot this fall.

They backed the president even as their brother makes his own bid for Biden's job.

Protesters have been arrested at Columbia and Yale as they've refused to move, calling for a break from Israel.

A tiny baby rescued from the womb after an Israeli airstrike in Gaza killed her mother is doing well.

The strike hit a residential building in the western Tel Sultan neighborhood, according to Gaza's civil defense.

A mortgage loan denial is disheartening, but there are ways to improve your chances of future approval.

If you're looking for ways to resolve your overwhelming credit card debt, these strategies are worth considering.

Long-term care insurance doesn't just cover nursing homes. Here are six other things it can cover.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

Cancer, heart disease, respiratory illnesses and kidney dysfunction among the health consequences of a warming planet.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

UAW claims historic victory, with an overwhelming majority of VW workers at Chattanooga factory voting to unionize.

Receive a $40 Digital Costco Shop Card when you join as a new member at Costco.com when entering PARA24 at checkout.

Splurge on a luxe Rimowa aluminum suitcase in 2024 and invest in a lifetime of travel.

Discover the best wireless headphones that support spatial audio.

A yearlong CBS News investigation explores a troubling new twist on romance scams that challenges investigators. The victims, often blinded by love, are being turned into unwitting co-conspirators.

CBS News legal analyst Rikki Klieman discusses the first day of the Trump trial and what to expect as testimony continues.

For more than two months, Israel has threatened to send troops into Rafah, despite the U.S. advising against the operation. However, even without the possible ground assault, the southern Gaza city experiences daily attacks.

A photo taken two days after the sinking of the RMS Titanic apparently shows the iceberg that doomed the so-called unsinkable ship in 1912. CBS News' John Dickerson has details.

Author Nicholas Sparks and the members of the creative team of “The Notebook” sit down with David Pogue to discuss the development of the famous novel into a Broadway musical. Then, Lee Cowan visits Vashon Island, Washington, to meet Thomas Dambo, the creator of wooden trolls. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Actor Marcia Gay Harden sits down with Seth Doane to discuss her CBS series "So Help Me Todd," her LGBTQ+ activism and her love of pottery. Then, Jonathan Vigliotti meets Julian Curi, the filmmaker behind the short film "Gruff." "Here Comes the Sun" is a closer look at some of the people, places and things we bring you every week on "CBS Sunday Morning."

Comedian and actor Kevin James sits down with Jim Axelrod to discuss his Amazon Prime special "Kevin James: Irregardless,” and the journey he has taken throughout his career. Then, Robert Costa visits the National Gallery of Art in Washington, D.C., to view an exhibit on artist Mark Rothko’s work. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Actor Paul Giamatti sits down with Lesley Stahl to discuss his latest film, “The Holdovers,” as well as other characters he has portrayed throughout his career. Then, Seth Doane travels to the Musée d’Orsay in Paris to learn about the AI-generated avatar of Vincent Van Gogh. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Actor Hilary Swank sits down with Tracy Smith to discuss her latest film, “Ordinary Angels.” Then, Conor Knighton travels to New Orleans to meet portraitist Michael Deas and to learn about his paintings found on stamps, Time magazine covers and more. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

Emmy and Tony Award-winning actress Bebe Neuwirth is back on Broadway, starring as Fraulein Schneider in the new revival of "Cabaret."

Chanel Miller, celebrated for her profound memoir "Know My Name," steps into a new creative realm with her children's book, "Magnolia Wu Unfolds It All." The story, both written and illustrated by Miller, follows two young friends on an adventurous quest through New York City to return misplaced socks from Magnolia's parents' laundromat.

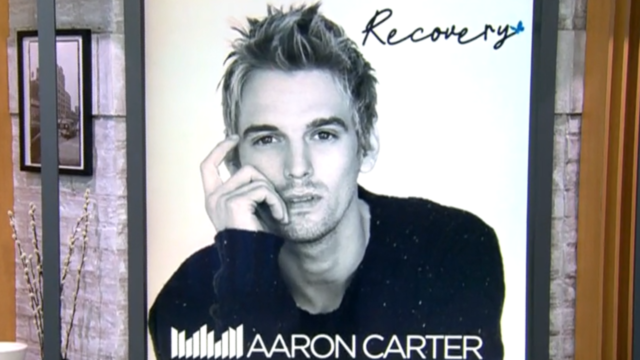

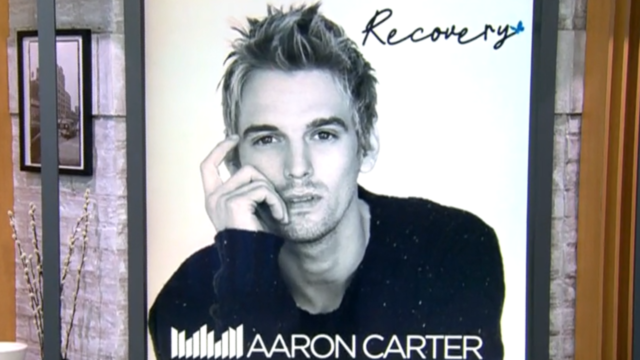

First on "CBS Mornings," we're getting a first listen to a never-before-heard song from Aaron Carter. Carter died in 2022 after struggling with addiction and mental health issues. Now, his team and his sister, Angel Carter Conrad, are releasing his previously unheard music. "The Recovery Album" comes out May 24. Part of the proceeds will go to the nonprofit "The Kids Mental Health Foundation," formerly known as "On Our Sleeves."

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

In California, we dine out at a restaurant powered by robots. Then in Washington, we take a sip of a beanless cup of coffee, which aims to reduce the environmental impact of the popular beverage. Watch these stories and more on "Eye on America" with host Michelle Miller.

In New York, we tour a unique museum that’s home to an extensive collection of toys, games and playgrounds. Then, we sit down with NBA superstar Steph Curry to discuss his heartwarming new children’s book. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Arizona, we learn why flag football is becoming an increasingly popular sport, especially among girls. Then in New York, we meet with descendants of some of the most notable suffragists of the 20th century. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Connecticut, we meet the preservationists who are giving dilapidated lighthouses new life. Then in California, we learn about the efforts to restore an iconic fishing boat. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Louisiana, we learn how a devastating drought has greatly diminished the area’s crawfish supply. Then in Ohio, we tour a small business that’s seeing promising results from a four-day work week model. Watch these stories and more on Eye on America with host Michelle Miller.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

A surfing accident left New York teacher Billy Keenan paralyzed, but when he received a call from a police officer, his life changed.

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

A mom was worried about what her son, who has autism, would do after high school. So she opened the So Much To Give cafe, a restaurant in Cedars, Pennsylvania, that employs people with disabilities – and helps them grow.

A mom worried about her son with autism opens an inclusive cafe that employs people with disabilities. The community around Paradise, California, rallies behind a woman whose beloved pet was stolen. Plus, more heartwarming stories.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

Jurors in former President Donald Trump's trial in New York heard testimony from a former media executive about his efforts to bury negative stories about Trump before the 2016 presidential election.

Surprise guests, a broken foot and a history-making headliner.

Regulators prohibit new noncompetes, which impede millions of U.S. workers from getting a better job.

Footage shows wildlife authorities trying to rein in a large alligator that wandered onto MacDill Air Force Base.

Angel Carter Conrad talks about her brother Aaron Carter, his death and how she hopes his legacy and previously unheard music can help others.

Regulators prohibit new noncompetes, which impede millions of U.S. workers from getting a better job.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Former President Donald Trump could receive a large windfall from his newly public media company, Trump Media & Technology Group.

Proposed deal "threatens to deprive consumers of the competition for affordable handbags," federal agency says.

Jurors in former President Donald Trump's trial in New York heard testimony from a former media executive about his efforts to bury negative stories about Trump before the 2016 presidential election.

Regulators prohibit new noncompetes, which impede millions of U.S. workers from getting a better job.

Trump made 10 social media posts that were "threatening, inflammatory," prosecutors said, arguing he should pay a fine for each post.

The Senate advanced the foreign aid package, which includes a provision that could lead to a ban on TikTok, after months of disagreement in Congress.

As of the end of March, more than 187,000 Ukrainians have arrived in the U.S. under the Uniting for Ukraine program, resettling with resounding efficiency and relatively little controversy.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Warmer weather is prime time for ticks that can carry Lyme disease and other illnesses. Here's how to spot them and get rid of them.

Tires emit huge volumes of particles and chemicals as they roll along the highway, and researchers are only beginning to understand the threat. One byproduct of tire use, 6PPD-q, is in regulators' crosshairs after it was found to be killing fish.

Cancer, heart disease, respiratory illnesses and kidney dysfunction among the health consequences of a warming planet.

To reduce recidivism, some rural counties are hiring community health workers or peer support specialists to connect people leaving custody to mental health, substance use treatment, medical services and jobs.

The Netzah Yehuda Battalion of the Israel Defense Forces has faced criticism for its conduct. Will the U.S. take action?

At least 77 students from the women-only college at Cambridge University were recruited to the code breaking station during World War II.

The photo of Prince Louis is said to have been taken by his mother Catherine, Princess of Wales.

The wreck is "partly disintegrated," but some remnants have been "very well preserved."

A new U.K. law means asylum seekers arriving on British shores without prior permission can be deported to East Africa.

Surprise guests, a broken foot and a history-making headliner.

Eric Church is revered as one of country music's most respected figures, often described as Nashville's renegade. But he admits that even after his success, he sometimes still sees himself as an outsider.

Angel Carter Conrad talks about her brother Aaron Carter, his death and how she hopes his legacy and previously unheard music can help others.

Emmy and Tony Award-winning actress Bebe Neuwirth is back on Broadway, starring as Fraulein Schneider in the new revival of "Cabaret."

Chanel Miller, celebrated for her profound memoir "Know My Name," steps into a new creative realm with her children's book, "Magnolia Wu Unfolds It All." The story, both written and illustrated by Miller, follows two young friends on an adventurous quest through New York City to return misplaced socks from Magnolia's parents' laundromat.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

Secretary of Commerce Gina Raimondo is at the center of a global competition for semiconductor dominance. It's a battle that also puts her at the center of two of the hottest global national security hotspots. Lesley Stahl of 60 Minutes spoke with Raimondo for the broadcast.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

More than 100 nations, including the United States, have agreed to protect 30% of the world's oceans by 2030.

Relatively few Americans say they know a lot about President Biden's initiatives to combat climate change, according to a CBS News poll. Carolyn Kissane, a New York University global affairs associate dean and professor, joins CBS News with more on Biden's climate policies.

A photo taken two days after the sinking of the RMS Titanic apparently shows the iceberg that doomed the so-called unsinkable ship in 1912. CBS News' John Dickerson has details.

Despite how terrifying sharks might seem, the creatures are critical to the survival of the world's oceans. Oceans generate 50% of the oxygen on the planet and absorb 90% of excess heat created by global warming. CBS News senior national and environmental correspondent Ben Tracy spoke with conservationists in the Bahamas.

A new CBS poll finds that most of the public favors the U.S. taking steps to address climate change. CBS News executive director of elections and surveys Anthony Salvanto breaks down the numbers.

Climate change could cause a $38 trillion income loss per year globally by 2049, according to a new study by the Potsdam Institute for Climate Impact Research. CBS News' Lilia Luciano breaks down the numbers.

Larry Webb confessed to shooting and killing Susan and Natasha "Alex" Carter, who had been missing for 24 years, officials said.

The Justice Department announced a $138.7 million settlement with victims of former USA Gymnastics physician Larry Nassar. The civil settlement stems from allegations that the FBI failed to properly investigate sexual abuse claims against Nassar. CBS News Justice Department reporter Robert Legare has more.

Over 100 victims of Larry Nassar, who was convicted of sexual abuse and child pornography, will receive a settlement from the Justice Department.

Authorities in Washington state are searching for a former officer accused of killing two women and abducting a child.

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

In November 2023, NASA's Voyager 1 spacecraft stopped sending "readable science and engineering data."

In two weeks, Boeing's Starliner spacecraft is scheduled to launch its first piloted test flight, bringing two veteran NASA astronauts to the International Space Station. Astronaut Matt Dominick joined CBS News from the ISS to talk about the mission and life in space.

A process called cryopreservation allows cells to remain frozen but alive for hundreds of years. For some animal cells, the moon is the closest place that's cold enough.

The Lyrid meteor show is set to peak as the week begins.

April's full moon, known as the Pink Moon, will reach peak illumination on Tuesday, but it will appear full from Monday morning through Thursday morning.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

Construction has begun for a high-speed rail that would connect Los Angeles to Las Vegas by 2028. Pasi Lautala, the director of Michigan Tech University's Rail Transportation Program, joins CBS News with more.

The Senate is considering a bill passed by the House that would force ByteDance, TikTok's current owners, to sell the popular social media app. CBS News senior business and tech correspondent Jo Ling Kent breaks down how a forced sale would take place.

President Biden is visiting Tampa, Florida, Tuesday to campaign on federal abortion measures and reproductive rights as more states take up bans and restrictions. CBS News campaign reporter Aaron Navarro has the latest.

The first witness to testify in former President Donald Trump's "hush money" criminal trial, former CEO of American Media Inc. David Pecker, detailed a "catch and kill" process to prevent negative press coverage. CBS News' Errol Barnett and Graham Kates report.

Relatively few Americans say they know a lot about President Biden's initiatives to combat climate change, according to a CBS News poll. Carolyn Kissane, a New York University global affairs associate dean and professor, joins CBS News with more on Biden's climate policies.