End of jury selection in Trump trial caps frenetic first week

The jury selection process in former President Donald Trump's New York trial came to a close on Friday, part of a flurry of activity that marked the end of a dizzying first week.

Watch CBS News

The jury selection process in former President Donald Trump's New York trial came to a close on Friday, part of a flurry of activity that marked the end of a dizzying first week.

The New York attorney general filed the state's opposition to the company providing Donald Trump's $175 million bond, posted while his appeal is pending.

The CDC estimates the U.S. could reach 300 measles cases this year.

Only one of two opposing abortion ballot measures may qualify for the Colorado ballot this fall. An anti-abortion initiative failed to gather enough signatures.

A person self-immolated at a park across from the courthouse where former President Donald Trump's New York criminal trial is taking place.

Democrats may have to offer Johnson a lifeline if it comes to a vote, given Republicans' razor-thin majority.

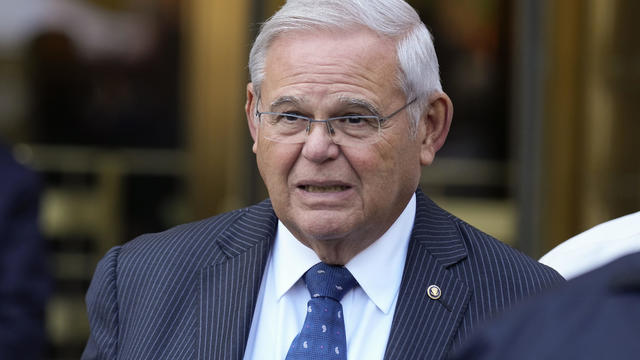

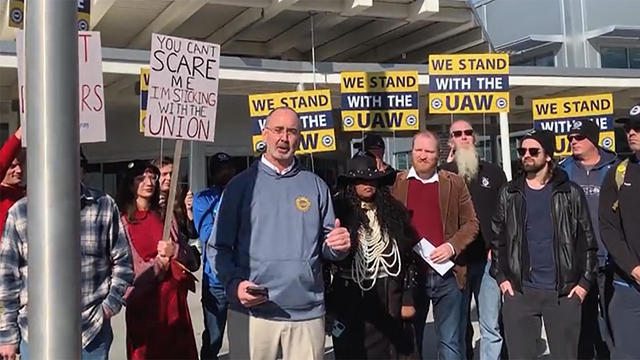

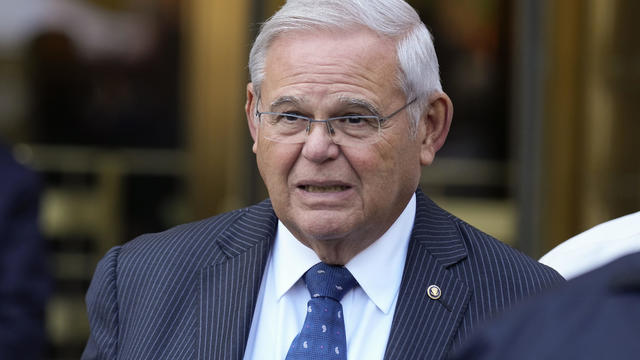

A judge granted a one week delay in the corruption trial of New Jersey Sen. Bob Menendez Friday, but the senator was not physically in court. He joined the proceedings by phone.

Trump Media & Technology Group sent a letter to Nasdaq warning that so-called "naked" short selling could be impacting its stock.

Texas state law says a child under the age of 10 doesn't have criminal culpability, law enforcement said.

Swift broke her own records, Spotify said, and now owns the record for the top three most-streamed albums in a single day.

The first time Emouree went to the cemetery with her grandmother, she couldn't understand why everyone else got a giant granite headstone, but her mother just received a tiny metal one.

The singer was found deceased at her home, a representative said.

Hundreds of teens had skipped school to meet in the Greenbelt, Maryland, park for a water gun fight, police said.

Caretaker Jessy Kurczewski says her friend mixed vodka and Visine for a buzz.

The RNC announced an ambitious initiative to monitor vote processing in the 2024 presidential election.

Charlie Bird — the "major Swiftie" of the two — had the idea after the singer announced her new album "The Tortured Poets Department" at the Grammys.

Eliminating player "proposition" bets may be one way to discourage athletes from betting on sports, experts said.

Direct conflict between Israel and Iran, which threaten global oil supplies and could drive up energy costs, has investors on edge.

The jury selection process in former President Donald Trump's New York trial came to a close on Friday, part of a flurry of activity that marked the end of a dizzying first week.

Under the 5th Amendment, the jury is prohibited from holding it against former President Donald Trump if he does not testify.

The jurors are tasked with deciding the outcome of the first criminal trial of a former president in U.S. history.

They backed the president even as their brother makes his own bid for Biden's job.

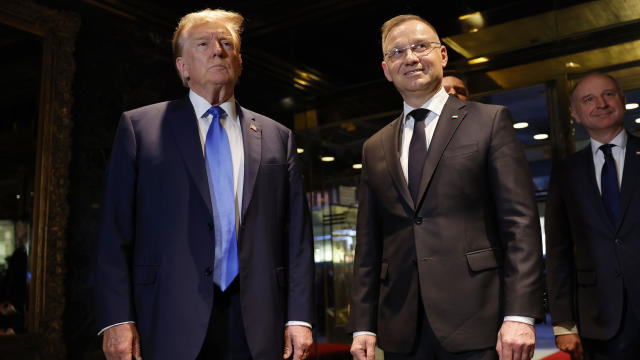

It came with Europe bracing for the possibility of a second Trump term.

The allies want the leaders to reconnect ahead of another potential Trump term, sources confirm.

Two U.S. officials tell CBS News an Israeli missile has hit Iran in apparent retaliation for the recent drone and missile attack on the Jewish state.

The Treasury Department announced sanctions on two entities accused of fundraising for extremist West Bank settlers.

Rep. Ilhan Omar's daughter says she was one of three students suspended from Barnard College.

Considering adding gold to your retirement portfolio? Here's why you may want to act now.

Here's why long-term care insurance is a better way to plan for long-term care costs than paying on your own.

Borrowing your home equity could lead to savings compared to other options. Find out how much you'd save here.

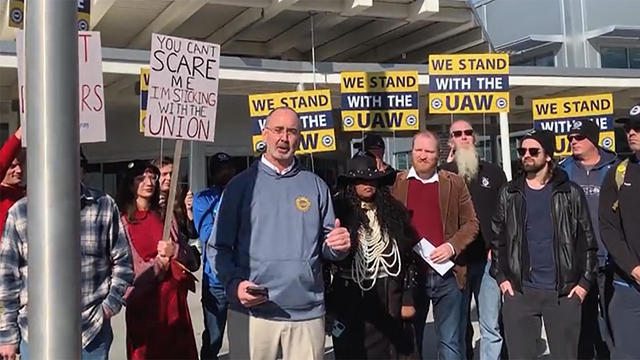

If the UAW prevails, the Chattanooga factory would be the only unionized foreign commercial carmaker in the U.S.

Direct conflict between Israel and Iran, which threaten global oil supplies and could drive up energy costs, has investors on edge.

Eliminating player "proposition" bets may be one way to discourage athletes from betting on sports, experts said.

Retailers are ditching and limiting shelf-checkout at some stores, particularly those hit by theft and customer complaints.

Trump Media & Technology Group sent a letter to Nasdaq warning that so-called "naked" short selling could be impacting its stock.

From Hey Dude shoes to a luxury toilet upgrade, Sam's Club shoppers are going wild for these trending products.

For the most immersive listening experience, choose wireless earbuds with noise cancellation and spatial audio.

Find that special someone by signing up for one of the undeniably best dating apps in 2024.

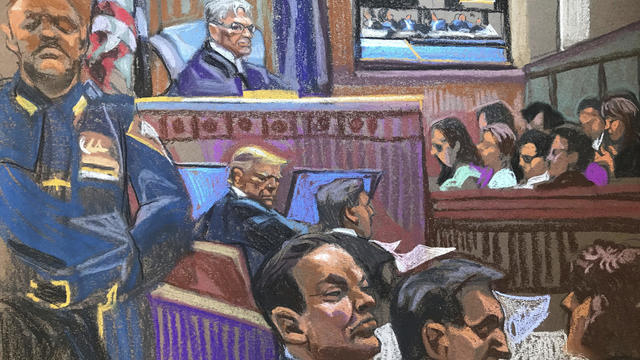

With the full jury chosen in former President Donald Trump's "hush money" trial, the stage is now set for opening statements to begin next week in the first criminal prosecution of a former U.S. president. Robert Costa was inside the court Friday.

"A man set himself on fire Friday outside the Manhattan courthouse where former President Donald Trump is on trial in his ""hush money"" case. Emergency crews rushed to the scene to extinguish the flames, and the man was taken to a local hospital, where he is said to be in critical condition. Jericka Duncan reports. "

Senior U.S. officials confirmed that Israeli missiles struck Iran Friday morning, but little else is known about the extent of the attack or any potential damage. Both countries appear to be downplaying the strikes, suggesting an effort to deescalate tensions. Debora Patta has more from Jerusalem.

The House is moving closer to passing foreign aid bills that would provide billions of dollars in stalled security funding to Ukraine, Israel and Taiwan. A rare bipartisan vote could come this weekend before heading to the Senate. Scott MacFarlane reports from Capitol Hill, where House Speaker Mike Johnson is facing backlash from hardline Republicans.

With the full jury chosen in former President Donald Trump's "hush money" trial, the stage is now set for opening statements to begin next week in the first criminal prosecution of a former U.S. president. Robert Costa was inside the court Friday.

A man set himself on fire Friday outside the Manhattan courthouse where former President Donald Trump is on trial in his "hush money" case. Emergency crews rushed to the scene to extinguish the flames, and the man was taken to a local hospital, where he is said to be in critical condition. Jericka Duncan reports.

Senior U.S. officials confirmed that Israeli missiles struck Iran Friday morning, but little else is known about the extent of the attack or any potential damage. Both countries appear to be downplaying the strikes, suggesting an effort to deescalate tensions. Debora Patta has more from Jerusalem.

The House is moving closer to passing foreign aid bills that would provide billions of dollars in stalled security funding to Ukraine, Israel and Taiwan. A rare bipartisan vote could come this weekend before heading to the Senate. Scott MacFarlane reports from Capitol Hill, where House Speaker Mike Johnson is facing backlash from hardline Republicans.

Police in Maryland say they stopped a teenager who was planning a school shooting in the days ahead. An 18-year-old student was arrested and charged after authorities reviewed the teen's writings and internet searches. Nicole Sganga reports on what led authorities to the suspect.

Taylor Swift broke her own records, Spotify said, and now owns the record for the top three most-streamed albums in a single day.

The singer was found deceased at her home, a representative said.

Starbucks unveiled the new cups ahead of Earth Day and as a new report warns plastic production emissions are even greater than those from aviation.

Renée Fleming is a five-time Grammy winner, a Kennedy Center honoree and a longtime advocate for the healing power of the arts. For her new book "Music and Mind," Fleming collected essays from leading scientists, artists and health care providers. They look at the powerful impact that music and the arts can have on our health.

"E! News" co-host Keltie Knight is revealing details about her private battle with a chronic health condition in hopes of helping others. The Emmy Award winner revealed last month that she was having a hysterectomy to treat a chronic and severe form of anemia. She spoke candidly about the decision on Instagram.

Iranian officials are downplaying an early Friday Israeli military strike near the city of Isfahan in central Iran. CBS News' Debora Patta and Weijia Jiang have more.

Taylor Swift released her 11th studio album, "The Tortured Poets Department," at midnight Eastern on Friday, but the excitement didn't end there. The pop star surprised fans with an additional 15 tracks two hours later. Steven Sullivan, a longtime fan with a heavily-followed Taylor Swift TikTok account, joins CBS News to share his thoughts on the record.

Millions of Jewish people around the world will observe Passover starting on Monday. But this year, with the ongoing Israel-Hamas war, there are additional concerns about staying safe during the holiday. CBS News homeland security and justice reporter Nicole Sganga explains how cities are handling security concerns.

Saturday marks 25 years since the mass shooting at Columbine High School. David Hogg, who survived a massacre at his high school in Parkland, Florida, joins CBS News to discuss the ongoing push for change.

A full jury, including six alternates, has finally been seated for the New York criminal trial against former President Donald Trump. Meanwhile, outside the courthouse, a man was rushed to the hospital after setting himself on fire. CBS News' Jericka Duncan and Robert Costa have the latest.

Charlie Bird — the "major Swiftie" of the two — had the idea after the singer announced her new album "The Tortured Poets Department" at the Grammys.

Spencer, the official mascot of the Boston Marathon, is honored by his community. David Begnaud introduces us to a woman who calls herself a "bad weather friend" – because she's there when you need her most. Plus, more heartwarming stories.

Russ Cook says the scariest part of his run through Africa was "on the back of a motorbike, thinking I was about to die."

A trendsetting third grader creates a school tradition to don dapper outfits on Wednesdays. A retiree makes it her mission to thank those who may be in thankless jobs. Plus, more heartwarming and inspiring stories.

Lyn Story is a retiree whose mission is to be the "bad weather friend," someone who is there for you in a time of need. David Begnaud shows how her huge heart led to life-changing friendships.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

The first time Emouree went to the cemetery with her grandmother, she couldn't understand why everyone else got a giant granite headstone, but her mother just received a tiny metal one.

Texas state law says a child under the age of 10 doesn't have criminal culpability, law enforcement said.

Only one of two opposing abortion ballot measures may qualify for the Colorado ballot this fall. An anti-abortion initiative failed to gather enough signatures.

Taylor Swift broke her own records, Spotify said, and now owns the record for the top three most-streamed albums in a single day.

The RNC announced an ambitious initiative to monitor vote processing in the 2024 presidential election.

If the UAW prevails, the Chattanooga factory would be the only unionized foreign commercial carmaker in the U.S.

In the next day or two, bitcoin is expected to go through a preprogrammed event that will cut new production of the cryptocurrency.

Retailers are ditching and limiting shelf-checkout at some stores, particularly those hit by theft and customer complaints.

Eliminating player "proposition" bets may be one way to discourage athletes from betting on sports, experts said.

Trump Media & Technology Group sent a letter to Nasdaq warning that so-called "naked" short selling could be impacting its stock.

Only one of two opposing abortion ballot measures may qualify for the Colorado ballot this fall. An anti-abortion initiative failed to gather enough signatures.

The RNC announced an ambitious initiative to monitor vote processing in the 2024 presidential election.

The New York attorney general filed the state's opposition to the company providing Donald Trump's $175 million bond, posted while his appeal is pending.

A judge granted a one week delay in the corruption trial of New Jersey Sen. Bob Menendez Friday, but the senator was not physically in court. He joined the proceedings by phone.

A person self-immolated at a park across from the courthouse where former President Donald Trump's New York criminal trial is taking place.

The CDC estimates the U.S. could reach 300 measles cases in 2024 — more than the recent peak two years ago.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

A landmark review for Britain's National Health Service found young people have been let down by "remarkably weak" evidence backing medical interventions in gender care.

Organic option is best when buying certain produce, especially blueberries, nonprofit group says in analysis of chemical residues.

British lawmakers have backed legislation that would see the legal age to buy tobacco increase by one year every year until it's eventually banned.

North Korea's latest launch to boost Kim Jong Un's image wasn't a missile, but a song and music video all about the "Friendly Father."

The Treasury Department announced sanctions on two entities accused of fundraising for extremist West Bank settlers connected to violence against Palestinians.

The break in tradition does not sit well with the Association of Summer Olympic Committee, who said it undermines "the value of Olympism and the uniqueness of the games."

The Vasuki indicus specimen dates back 47 million years and is more than double the average size of similar snakes, like pythons.

Paris police cordoned off an area around an Iranian consulate amid reports of a man threatening to detonate a bomb, but a suspect was quickly detained.

Taylor Swift broke her own records, Spotify said, and now owns the record for the top three most-streamed albums in a single day.

Charlie Bird — the "major Swiftie" of the two — had the idea after the singer announced her new album "The Tortured Poets Department" at the Grammys.

The singer was found deceased at her home, a representative said.

The soprano recounted an anecdote from the book's foreword by Francis Collins, which describes an impromptu sing-along at a dinner party attended by Supreme Court justices.

Fans are furiously dissecting the lyrics of "The Tortured Poets Department," with some speculating the tracks are about Joe Alwyn, Matty Healy, Travis Kelce and Kim Kardashian.

Computer chip maker Intel is at the center of the latest high-tech race between the U.S. and China. Jo Ling Kent visited their state-of-the-art facility in Oregon for an in-depth report.

A bipartisan group of lawmakers has introduced a bill supporting the development of nuclear fusion power. Hank Jenkins-Smith, professor of public policy at the University of Oklahoma, joins CBS News to discuss.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

Sen. Maria Cantwell is backing an amended bill that could lead to a ban of TikTok in the U.S.

Artificial intelligence has become so advanced it has now surpassed human performance in several basic tasks, according to a new report from Stanford University's Institute for Human-Centered Artificial Intelligence. Russell Wald, deputy director of the institute, joins CBS News to unpack more key findings from the study.

Starbucks unveiled the new cups ahead of Earth Day and as a new report warns plastic production emissions are even greater than those from aviation.

A report from the United Nations determined that 1 million species are threatened with extinction. Dr. John Wiens from the University of Arizona believes that number is far higher based on his research. He says climate change is quickening the threat of extinction for species, including a 3-million-year-old lizard population previously found in the Arizona mountains.

A disappearing lizard population in the mountains of Arizona shows how climate change is fast-tracking the rate of extinction.

Some of the most critically endangered birds on the planet have been released back into the wild. CBS News national environmental correspondent David Schechter has more on the harsh conditions Puerto Rican parrots face, and the people working to save them.

Scientists are using a range of tools to protect the endangered wildlife that could disappear in coming decades.

Texas state law says a child under the age of 10 doesn't have criminal culpability, law enforcement said.

Police in Maryland say they stopped a teenager who was planning a school shooting in the days ahead. An 18-year-old student was arrested and charged after authorities reviewed the teen's writings and internet searches. Nicole Sganga reports on what led authorities to the suspect.

A judge granted a one week delay in the corruption trial of New Jersey Sen. Bob Menendez Friday, but the senator was not physically in court. He joined the proceedings by phone.

Hundreds of teens had skipped school to meet in the Greenbelt, Maryland, park for a water gun fight, police said.

The Columbine High School mass shooting in Littleton, Colorado, left behind many survivors and families who are still dealing with the massacre's trauma. Zach Cartaya, a Columbine student and co-founder of The Rebels Project, joins CBS News with more on his mission to help other victims of violence.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

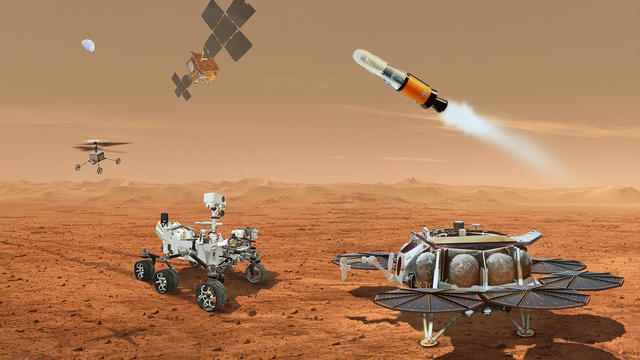

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

It was a "bittersweet moment" as United Launch Alliance brought the Delta program to a close.

NASA flight engineers managed to photograph and videotape the moon's shadow on Earth about 260 miles below them.

Millions of Americans poured into the solar eclipse’s path of totality to watch in wonder. The excitement was shared across generations for the rare celestial event that saw watch parties across the country as almost all of the continental U.S. saw at least a partial solar eclipse.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

Iranian officials are downplaying an early Friday Israeli military strike near the city of Isfahan in central Iran. CBS News' Debora Patta and Weijia Jiang have more.

Millions of Jewish people around the world will observe Passover starting on Monday. But this year, with the ongoing Israel-Hamas war, there are additional concerns about staying safe during the holiday. CBS News homeland security and justice reporter Nicole Sganga explains how cities are handling security concerns.

Saturday marks 25 years since the mass shooting at Columbine High School. David Hogg, who survived a massacre at his high school in Parkland, Florida, joins CBS News to discuss the ongoing push for change.

A full jury, including six alternates, has finally been seated for the New York criminal trial against former President Donald Trump. Meanwhile, outside the courthouse, a man was rushed to the hospital after setting himself on fire. CBS News' Jericka Duncan and Robert Costa have the latest.

Police in Maryland say they stopped a teenager who was planning a school shooting in the days ahead. An 18-year-old student was arrested and charged after authorities reviewed the teen's writings and internet searches. Nicole Sganga reports on what led authorities to the suspect.