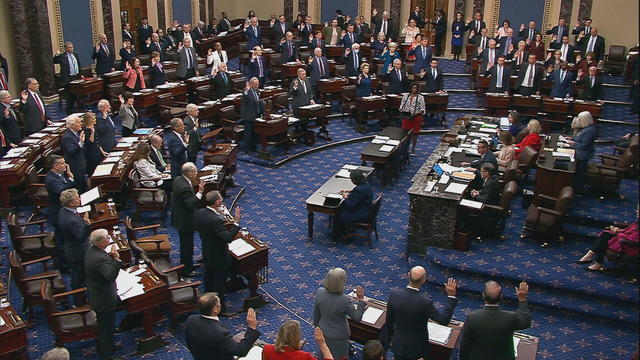

Senate rejects Mayorkas impeachment charges at trial, ending GOP bid to oust him

The Senate's 51-member Democratic majority voted to dismiss both charges as unconstitutional over the objections of Republican members.

Watch CBS News

The Senate's 51-member Democratic majority voted to dismiss both charges as unconstitutional over the objections of Republican members.

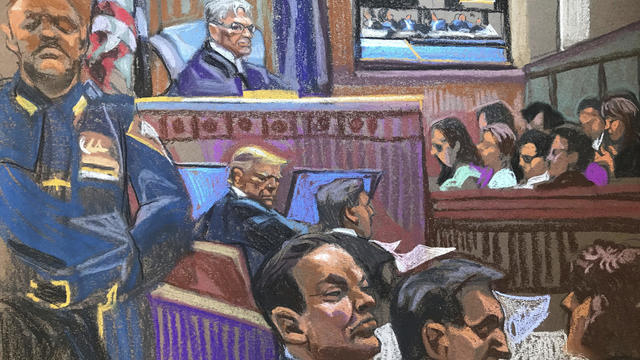

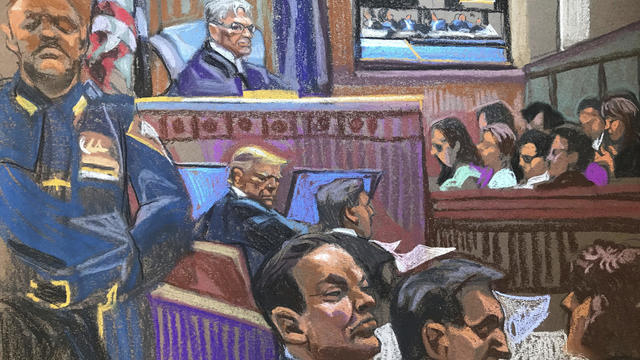

Under the 5th Amendment, the jury is prohibited from holding it against former President Donald Trump if he does not testify.

House Republican leadership on Wednesday unveiled three bills that are part of a complicated plan by Speaker Mike Johnson to approve more foreign aid.

The nearly 400-page investigative report released Wednesday raises new and troubling questions about Maui County Mayor Richard Bissen.

If approved, the settlement will be paid out by the Justice Department to 100 victims of Larry Nassar, who was convicted of sexual abuse and child pornography.

In an alibli court filing, lawyers for Bryan Kohberger, accused of fatally stabbing four University of Idaho students, claim he was "out driving" the night of the killings.

Water still covers some roads around Dubai International Airport, but flights are moving as the UAE bails out from a historic deluge.

O.J. Simpson's longtime lawyer in Las Vegas says the end came quickly.

A southern Minnesota community is mourning, supporting a family after their 1-year-old son fell to his death from a hotel window.

The White House says American workers face unfair competition from Chinese steel and aluminum imports.

Boeing engineer Sam Salehpour tells lawmakers that employees who raise concerns about safety issues at the company are "threatened."

A pair of vultures thought to be "actively dying" actually had too much to drink, wildlife rescuers in Connecticut say.

Columbia University President Dr. Minouche Shafik testified about antisemitism on college campuses before the House Committee on Education and the Workforce.

Asna Tabassum was set to speak at the University of Southern California's commencement ceremony, but the offer was rescinded.

America's mail carriers don't just face bad weather and aggressive dogs — they're also increasingly targets of violent crime.

The No. 1 pick in this year's WNBA draft is "going to raise all boats" for players in the league, one expert said.

One year after a brazen gold heist at the Toronto airport, nine suspects have been charged in an investigation police said "belongs in a Netflix series."

The author whose "Shopaholic" novels were adapted into the 2009 film "Confessions of a Shopaholic" announced she has a rare form of brain cancer.

The jurors are tasked with deciding the outcome of the first criminal trial of a former president in U.S. history.

CBS News Confirmed examines three viral claims that have emerged so far during Trump's first criminal trial.

The case stems from a "hush money" payment of $130,000 to adult film star Stormy Daniels in 2016.

The allies want the leaders to reconnect ahead of another potential Trump term, sources confirm.

He believes painting Trump as a "threat" to democracy is a crucial contrast to highlight in his campaign.

The call came in a joint statement by twelve major news organizations including CBS News.

UNICEF says a third of Gaza's infants and toddlers are acutely malnourished, but Israel blames the U.N. itself.

Details emerge of Iran's unprecedented direct attack on Israel, and how it was largely thwarted by the U.S. ally's defenses.

President Biden and Israeli Prime Minister Benjamin Netanyahu had a "good conversation," an official said.

Are you thinking about taking out a $15,000 home equity loan? Here's how much it will likely cost per month.

If you're facing mounting debt, there are a few good debt relief options you may want to consider right now.

Long-term care insurance can help cover your cost of care. Here's why you should act now if you're in your 70s.

The No. 1 pick in this year's WNBA draft is "going to raise all boats" for players in the league, one expert said.

The miniseries has led to a 93% increase in bookings in Ravello, a city about 15 minutes away from Atrani.

America's mail carriers don't just face bad weather and aggressive dogs — they're also increasingly targets of violent crime.

Elon Musk's 2018 compensation package is back for board re-certification after being voided by a Delaware court.

Workers said they're seeking higher pay, a safe and sanitary workplace and transparency in scheduling and rehiring.

From Hey Dude shoes to a luxury toilet upgrade, Sam's Club shoppers are going wild for these trending products.

Discover the best smart grills that make your outdoor grilling easier and more fool-proof than ever.

BJ's Wholesale Club normally costs $55 per year, but new members can get their first year free (after reward).

On the same day that America's top military leaders warned that Ukraine is running out of money and munitions in its war with Russia, House Republicans unveiled a long-awaited and long-stalled plan to provide military aid to Ukraine, along with two other bills to provide military assistance to Israel and Taiwan. Scott MacFarlane has details.

Sam Salehpour, a quality engineer at Boeing, was one of two whistleblowers who testified before a Senate committee Wednesday. He raised safety concerns with the company about the 787 Dreamliner. He claimed that Boeing is not following its own production guidelines when connecting key pieces of the Dreamliner fuselage and fears it could lead to a structural failure years down the line. Kris Van Cleave has details.

The Justice Department is in the final stages of an agreement with abuse victims of former USA Gymnastics physician Larry Nassar. Olympic stars Simone Biles, McKayla Maroney and Aly Raisman are among the gymnasts who sued the FBI. Caitlin Huey-Burns has the latest.

Caitlin Clark, the No. 1 overall pick in the WNBA draft this week, had endorsement deals in college worth more than $3 million. However, her base salary as a rookie in the WNBA is capped at just over $76,000, which pales in comparison to her counterparts in the NBA. Jericka Duncan reports.

Sam Salehpour, a quality engineer at Boeing, was one of two whistleblowers who testified before a Senate committee Wednesday. He raised safety concerns with the company about the 787 Dreamliner. He claimed that Boeing is not following its own production guidelines when connecting key pieces of the Dreamliner fuselage and fears it could lead to a structural failure years down the line. Kris Van Cleave has details.

On the same day that America's top military leaders warned that Ukraine is running out of money and munitions in its war with Russia, House Republicans unveiled a long-awaited and long-stalled plan to provide military aid to Ukraine, along with two other bills to provide military assistance to Israel and Taiwan. Scott MacFarlane has details.

A nearly 400-page investigative report released Wednesday raises new and troubling questions about Maui County Mayor Richard Bissen and his response to last summer's wildfires, which left more than 100 people dead and destroyed thousands of homes and businesses. Jonathan Vigliotti has more.

Caitlin Clark, the No. 1 overall pick in the WNBA draft this week, had endorsement deals in college worth more than $3 million. However, her base salary as a rookie in the WNBA is capped at just over $76,000, which pales in comparison to her counterparts in the NBA. Jericka Duncan reports.

The Department of Homeland Security Wednesday announced a first-of-its-kind campaign to help protect children against sexual exploitation online. The new campaign, Know2Protect, works with partners from the public and private sector to educate parents and their children on how to combat and report exploitation. Jo Ling Kent has more.

Caitlin Clark, the No. 1 overall pick in the WNBA draft this week, had endorsement deals in college worth more than $3 million. However, her base salary as a rookie in the WNBA is capped at just over $76,000, which pales in comparison to her counterparts in the NBA. Jericka Duncan reports.

The author whose "Shopaholic" novels were adapted into the 2009 film "Confessions of a Shopaholic" announced she has a rare form of brain cancer.

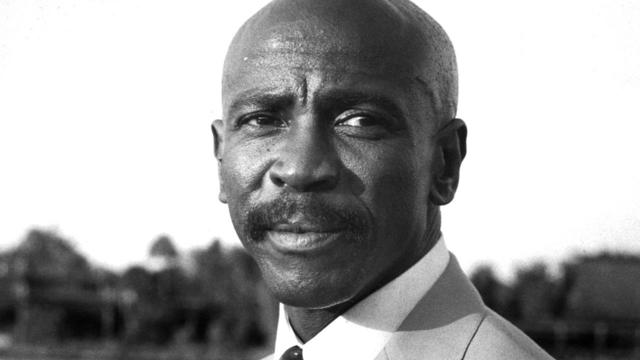

Trumpeter Kermit Ruffins has performed around the world, but he's sharing how a personal tragedy involving gun violence has impacted his family and music.

Renowned New Orleans trumpeter Kermit Ruffins, celebrated for his performances on global stages, opens up on how his family's firsthand experience with gun violence has shaped his life and music.

Actor Hilarie Burton Morgan, renowned for her roles in "One Tree Hill" and "White Collar," is back with the second season of her docuseries, "True Crime Story: It Couldn't Happen Here." Each episode delves into a different murder case in small American towns, bringing attention to often-overlooked stories.

Artificial intelligence has become so advanced it has now surpassed human performance in several basic tasks, according to a new report from Stanford University's Institute for Human-Centered Artificial Intelligence. Russell Wald, deputy director of the institute, joins CBS News to unpack more key findings from the study.

Venezuela is the latest country to cut diplomatic ties with Ecuador over a raid on Mexico's Embassy in early April. Ryan Dubé, a reporter at The Wall Street Journal covering politics and economics in Latin America, joins CBS News to discuss how the raid impacts diplomacy in the region.

A Biden administration official claimed in 2023 that China had operated a spy base in Cuba since at least 2019. Cuban Deputy Foreign Minister Carlos Fernández de Cossío rejected those claims in an exclusive interview with CBS News immigration and politics reporter Camilo Montoya-Galvez.

President Biden called for tripling tariffs on Chinese steel and aluminum imports at a campaign stop in Pittsburgh on Wednesday. White House officials say China's industrial sector is problematic on multiple fronts. CBS News campaign reporter Aaron Navarro explains.

A new report from Hawaii's attorney general on the 2023 Maui wildfires takes a closer look at what contributed to the deadly flames. CBS News national correspondent Jonathan Vigliotti has more.

Spencer, the official mascot of the Boston Marathon, is honored by his community. David Begnaud introduces us to a woman who calls herself a "bad weather friend" – because she's there when you need her most. Plus, more heartwarming stories.

Russ Cook says the scariest part of his run through Africa was "on the back of a motorbike, thinking I was about to die."

A trendsetting third grader creates a school tradition to don dapper outfits on Wednesdays. A retiree makes it her mission to thank those who may be in thankless jobs. Plus, more heartwarming and inspiring stories.

Lyn Story is a retiree whose mission is to be the "bad weather friend," someone who is there for you in a time of need. David Begnaud shows how her huge heart led to life-changing friendships.

Nets star Mikal Bridges fulfills his dream of teaching by working at a school in Brooklyn for the day. A doctor overcomes the odds to help other survivors of catastrophic injuries. Plus, behind the scenes of Drew Barrymore's talk show, and more heartwarming stories.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

Thousands of Black college students expected for Orange Crush, an annual spring bash at Georgia's largest public beach, on Tybee Island, will be greeted by extra officers and numerous restrictions.

In an alibli court filing, lawyers for Bryan Kohberger, accused of fatally stabbing four University of Idaho students, claim he was "out driving" the night of the killings.

The nearly 400-page investigative report released Wednesday raises new and troubling questions about Maui County Mayor Richard Bissen.

The No. 1 pick in this year's WNBA draft is "going to raise all boats" for players in the league, one expert said.

If approved, the settlement will be paid out by the Justice Department to 100 victims of Larry Nassar, who was convicted of sexual abuse and child pornography.

The No. 1 pick in this year's WNBA draft is "going to raise all boats" for players in the league, one expert said.

Workers said they're seeking higher pay, a safe and sanitary workplace and transparency in scheduling and rehiring.

America's mail carriers don't just face bad weather and aggressive dogs — they're also increasingly targets of violent crime.

Boeing engineer Sam Salehpour tells lawmakers that employees who raise concerns about safety issues at the company are "threatened."

NPR had suspended Berliner after he claimed in an essay that the network had "lost America's trust" pushing progressive views.

Several of Robert F. Kennedy Jr.'s brothers and sisters are endorsing the president even as their brother makes his own bid for Biden's job.

Under the 5th Amendment, the jury is prohibited from holding it against former President Donald Trump if he does not testify.

The jurors are tasked with deciding the outcome of the first criminal trial of a former president in U.S. history.

House Republican leadership on Wednesday unveiled three bills that are part of a complicated plan by Speaker Mike Johnson to approve more foreign aid.

The White House says American workers face unfair competition from Chinese steel and aluminum imports.

British lawmakers have backed legislation that would see the legal age to buy tobacco increase by one year every year until it's eventually banned.

A new generation of deodorant products promise whole-body odor protection. Should you try one? Dermatologists share what to know.

New York City health officials are warning of a worrisome increase in the number of leptospirosis cases from contact with rat urine.

The $872 million most likely excludes any amount UnitedHealth may have paid to hackers in ransom.

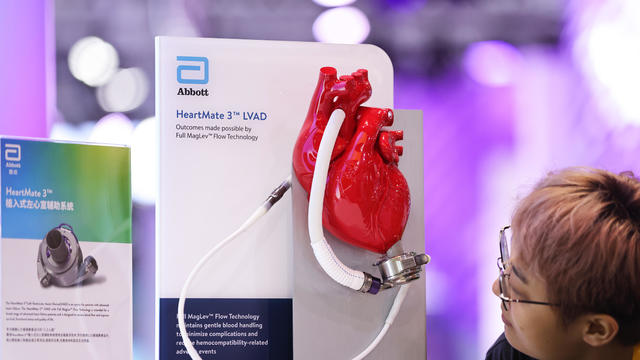

The recall comes years after surgeons say they first noticed problems with the HeartMate II and HeartMate 3, manufactured by Thoratec Corp., a subsidiary of Abbott Laboratories.

Water still covers some roads around Dubai International Airport, but flights are moving as the UAE bails out from a historic deluge.

Parts of central Asia, including Pakistan and Afghanistan, have been hit hard by unusually powerful rainstorms and flash floods.

One year after a brazen gold heist at the Toronto airport, nine suspects have been charged in an investigation police said "belongs in a Netflix series."

House Republican leadership on Wednesday unveiled three bills that are part of a complicated plan by Speaker Mike Johnson to approve more foreign aid.

British lawmakers have backed legislation that would see the legal age to buy tobacco increase by one year every year until it's eventually banned.

The author whose "Shopaholic" novels were adapted into the 2009 film "Confessions of a Shopaholic" announced she has a rare form of brain cancer.

Hilarie Burton Morgan said personal connections to the government and law enforcement communities inspired her involvement in true crime.

Trumpeter Kermit Ruffins has performed around the world, but he's sharing how a personal tragedy involving gun violence has impacted his family and music.

O.J. Simpson's longtime lawyer in Las Vegas says the end came quickly.

Renowned New Orleans trumpeter Kermit Ruffins, celebrated for his performances on global stages, opens up on how his family's firsthand experience with gun violence has shaped his life and music.

Artificial intelligence has become so advanced it has now surpassed human performance in several basic tasks, according to a new report from Stanford University's Institute for Human-Centered Artificial Intelligence. Russell Wald, deputy director of the institute, joins CBS News to unpack more key findings from the study.

The former president's media company announced plans to air news, religious channels and other content.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

The Biden administration is awarding Samsung $6.4 billion to expand American chipmaking. The company will spread the money across at least five facilities in Texas. Sujai Shivakumar, senior fellow at the Center for Strategic and International Studies, joins CBS News to assess the economic and technological impacts.

Roku said Friday a second security breach impacted more than 576,000 accounts after announcing in March that 15,000 accounts had been exposed by a hack. Emma Roth, a writer for The Verge, joins CBS News with more details.

Water still covers some roads around Dubai International Airport, but flights are moving as the UAE bails out from a historic deluge.

At least a million species may disappear from Earth in coming decades due to a warming climate, but scientists are using a range of tools to protect plants and animals. CBS News environmental correspondent David Schechter reports.

Dubai was slammed Tuesday with an average year's worth of rain in a single day, halting operations at one of the world's busiest airports and stranding cars on roadways not used to such extreme downpours. Here's why, in some places, less than 6 inches of rain can be so catastrophic.

A major global coral bleaching event is occurring for the second time in 10 years, according to the National Oceanic and Atmospheric Administration. Derek Manzello, A coral reef ecologist and NOAA reef watch coordinator, joins CBS News with more.

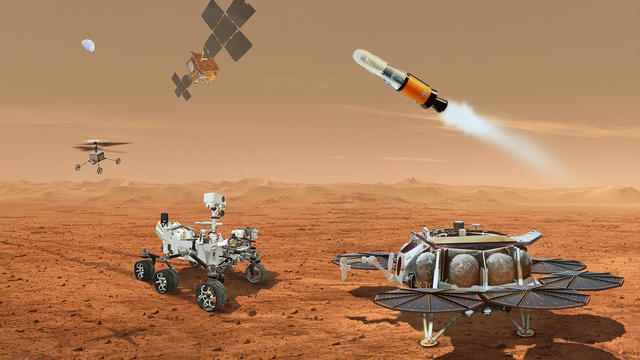

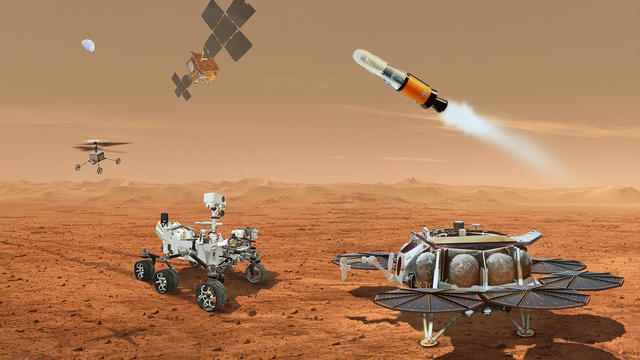

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

In an alibli court filing, lawyers for Bryan Kohberger, accused of fatally stabbing four University of Idaho students, claim he was "out driving" the night of the killings.

If approved, the settlement will be paid out by the Justice Department to 100 victims of Larry Nassar, who was convicted of sexual abuse and child pornography.

One year after a brazen gold heist at the Toronto airport, nine suspects have been charged in an investigation police said "belongs in a Netflix series."

A financial counselor for the U.S. Army has admitted to tricking the surviving beneficiaries of fallen soldiers out of millions while profiting himself.

Salvatore Rubino kicked illegal gambling profits to the Genovese crime family, prosecutors say.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

It was a "bittersweet moment" as United Launch Alliance brought the Delta program to a close.

NASA flight engineers managed to photograph and videotape the moon's shadow on Earth about 260 miles below them.

Millions of Americans poured into the solar eclipse’s path of totality to watch in wonder. The excitement was shared across generations for the rare celestial event that saw watch parties across the country as almost all of the continental U.S. saw at least a partial solar eclipse.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

At least a million species may disappear from Earth in coming decades due to a warming climate, but scientists are using a range of tools to protect plants and animals. CBS News environmental correspondent David Schechter reports.

For the second time, Republicans in the Arizona Legislature thwarted an effort to repeal the state's 1864 abortion law, which was upheld last week by the state Supreme Court. This comes despite high-profile Republicans like former President Donald Trump saying the ban goes too far. Elise Preston has more.

In a rare and exclusive interview, Cuban Deputy Foreign Minister Carlos Fernández de Cossío, the island nation's point person in U.S.-Cuba relations, discusses his thoughts on the record number of Cubans processed at the southern border, the findings of a Cuban investigation into Havana Syndrome, and more with CBS News immigration and politics reporter Camilo Montoya-Galvez.

Artificial intelligence has become so advanced it has now surpassed human performance in several basic tasks, according to a new report from Stanford University's Institute for Human-Centered Artificial Intelligence. Russell Wald, deputy director of the institute, joins CBS News to unpack more key findings from the study.

The Department of Homeland Security Wednesday announced a first-of-its-kind campaign to help protect children against sexual exploitation online. The new campaign, Know2Protect, works with partners from the public and private sector to educate parents and their children on how to combat and report exploitation. Jo Ling Kent has more.