Georgia court will review decision allowing Fani Willis to stay on Trump case

Judge Scott McAfee allowed District Attorney Fani Willis to remain on the case involving former President Donald Trump if Nathan Wade resigned, which he did.

Watch CBS News

Judge Scott McAfee allowed District Attorney Fani Willis to remain on the case involving former President Donald Trump if Nathan Wade resigned, which he did.

Three public school district leaders testified before a congressional panel Tuesday on incidents of antisemitism in their schools.

A senior administration official linked the pause to Israel's operation in Rafah.

The trend of teens and tweens obsessing over skin care is "at its max," one dermatologist says.

A man was convicted in the 2001 murder of Amanda Gonzales, a U.S. Army soldier who was 19 at the time of her death.

Indian police have arrested the parents of a 6-year-old deaf and nonverbal boy who's body was found in a canal with signs of a crocodile attack.

Rep. Marjorie Taylor Greene said she would force a vote on ousting House Speaker Mike Johnson this week, but appeared to be retreating on the threat — for now.

After more than three decades, Ventura police have solved the murder of Danielle Clause, who was found dead on a hillside in 1991.

Gov. Tim Walz on Tuesday signed a ticket transparency bill aimed at protecting music fans when they buy tickets for shows.

Jordyn Zimmerman is autistic and nonspeaking at 29, but she's still making her voice heard.

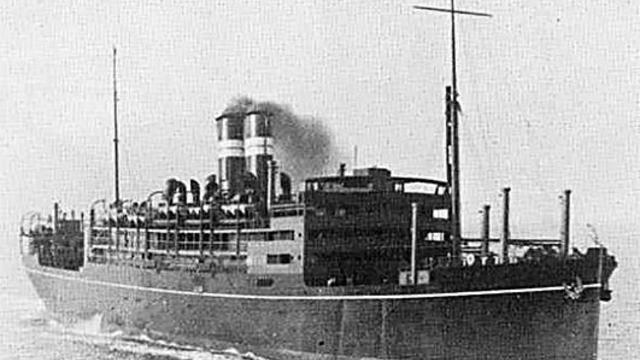

The SS Tilawa was carrying hundreds of passengers and thousands of silver bars when it sank in 1942.

In the video, the surface of the sun appears furred with dark yellow material as beams of gold swoop overhead.

The worker stabbed a woman and two guards who tried to intervene before being subdued and held in a "shipboard jail," the affidavit says.

FTX says that nearly all of its customers will receive the money back they are owed, two years after the cryptocurrency exchange imploded.

You deserve a treat. And this spring, Mother Nature is providing a seemingly endless supply – trillions of cicadas.

2 days after an apartment building collapsed in South Africa, the search continued for 42 construction workers still believed to be buried in the rubble

A new study coming from researchers at CU Boulder, reveals that precipitation, not temperature, will keep the Colorado River fuller than previous research told us.

A former Mayo Clinic resident accused of fatally poisoning his wife last year may have been identifying as a widower before she even died, a new warrant reveals.

Stormy Daniels was called to the witness stand to testify at former President Donald Trump's trial in New York on Tuesday.

The start date for former President Trump's classified documents trial was originally scheduled for May 20.

The judge said Trump violated his gag order on April 22 when he commented on the political makeup of the jury.

Tiffany Smiley is challenging Rep. Dan Newhouse, one of the last two Republicans in the House who voted to impeach Trump.

The 82-year-old from Vermont announced in a social media video that he'll seek a fourth term in the Senate.

Conservative groups look to peel off a key part of President Biden's base.

Jerusalem's Hand in Hand school sees Jewish and Arab kids learn together – and they're learning a lot more than just math and science.

The Israeli military says it's reopened the Kerem Shalom crossing into Gaza, a key terminal for the entry of humanitarian aid, but the nearby Rafah crossing seized by Israel was still closed.

College protesters are demanding divestment as a way to deliver change, although its effectiveness isn't clear cut.

CD rates are high this season. Here's how much interest you can earn based on a variety of deposits and terms.

Gold isn't the only precious metal you might want to buy in today's market.

It may be harder to get long-term care insurance with a pre-existing condition, but it's not impossible.

FTX says that nearly all of its customers will receive the money back they are owed, two years after the cryptocurrency exchange imploded.

Panera is phasing out a highly caffeinated selection of lemonade beverages that's at the center of several lawsuits.

FDIC Chair Martin Gruenberg is also a focus of the report, which claims he treated staff in a "demeaning and inappropriate manner."

Starbucks, once one of America's most cherished brands, is in a rut. Even long-time chief Howard Schultz is worried.

Video gamers eagerly awaiting a successor to Nintendo's hit Switch system finally got a clue on when to expect a new device.

Pro tip: You may want to buy Apple AirPods Pro 2 right now. They're deeply discounted ahead of Memorial Day.

Here's how, when and where to watch Game 2 of the Boston Bruins vs. Florida Panthers NHL Playoffs series tonight.

The Pacers are looking to bounce back against the Knicks today in Game 2 of the Eastern Conference semifinals.

Hundreds of thousands of people across the U.S. are losing their homeowners insurance, with four major companies ending coverage in California due to the growing risk of wildfires. Companies in Florida are canceling policies due to increased hurricane risks. Matthew Eby, the founder and CEO of First Street Foundation, a nonprofit that studies climate risks, joined CBS News to discuss .

Adult film actor Stormy Daniels took the stand in former President Donald Trump's criminal trial on Tuesday. The judge denied Trump's request for a mistrial based on her testimony. CBS News national correspondent Errol Barnett reports.

The White House is pressuring Israel not to launch a major invasion on Rafah. A senior administration official said one shipment of weapons, containing bombs, was paused last week. The U.S. is concerned Israel would use it on Rafah.

TikTok filed a lawsuit over U.S. legislation that could ban the social media app. It says a new law demanding it sever ties with the Chinese government is unconstitutional and is a free speech issue. However, supporters of the law say it's essential for national security.

A string of tornadoes this week has hit communities from Oklahoma to Michigan, leaving buildings in ruins and thousands without power across multiple states.

This week on "The Dish," "CBS Mornings" explores the increasingly popular Korean-American gastro-pub, Nowon, known for blending American and Asian cuisine.

As part of AAPI month, "CBS Mornings" partnered with the organization Gold House to celebrate its A 100 list, which recognizes this year's most impactful Asian-Pacific leaders. One of the honorees is actor Hoa Xuande. You may recognize him for his lead role in the HBO show "The Sympathizer." He stars alongside Sandra Oh and Robert Downey Jr. Jo Ling Kent met the rising star, whose unlikely Hollywood journey shows no signs of stopping.

Only six schools in Israel are not segregated among Arab and Jewish students. Educators at the handful of schools where Jewish and Arab students learn together are hoping to maintain peace and understanding amid the war in Gaza.

Peloton's head instructor and VP of Fitness Programming Robin Arzón joins "CBS Mornings" to talk about balancing motherhood with mental and physical strength.

Jordyn Zimmerman is autistic and nonspeaking at 29, but she's still making her voice heard.

As part of AAPI month, "CBS Mornings" partnered with the organization Gold House to celebrate its A 100 list, which recognizes this year's most impactful Asian-Pacific leaders. One of the honorees is actor Hoa Xuande. You may recognize him for his lead role in the HBO show "The Sympathizer." He stars alongside Sandra Oh and Robert Downey Jr. Jo Ling Kent met the rising star, whose unlikely Hollywood journey shows no signs of stopping.

Peloton's head instructor and VP of Fitness Programming Robin Arzón joins "CBS Mornings" to talk about balancing motherhood with mental and physical strength.

At 29 years old, Jordyn Zimmerman is autistic and nonspeaking but she's making her voice heard on some of the most prestigious stages. Jamie Wax sat down with Zimmerman in her first broadcast television interview to discuss the struggles she faced growing up, the way that a communication app on an iPad changed her life and her ability to connect with others.

Billboard's Carl Lamarre joins "CBS Mornings" to discuss the heated feud between hip-hop artists Drake and Kendrick Lamar.

In New York, we learn how a major hospital and a tech giant teamed up to develop a new form of MRI technology that utilizes AI for faster scans. Then in Massachusetts, we examine how private equity investors have impacted community hospital resources. Watch these stories and more on Eye on America with host Michelle Miller.

In Oklahoma, Nate Burleson shares his family’s personal connection to one of America’s darkest chapters. Then in Texas, we tour the renowned Kinsey Collection, the largest private holding of African American art and artifacts. Watch these stories and more on Eye on America with host Michelle Miller.

In California, we dine out at a restaurant powered by robots. Then in Washington, we take a sip of a beanless cup of coffee, which aims to reduce the environmental impact of the popular beverage. Watch these stories and more on "Eye on America" with host Michelle Miller.

In New York, we tour a unique museum that’s home to an extensive collection of toys, games and playgrounds. Then, we sit down with NBA superstar Steph Curry to discuss his heartwarming new children’s book. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Arizona, we learn why flag football is becoming an increasingly popular sport, especially among girls. Then in New York, we meet with descendants of some of the most notable suffragists of the 20th century. Watch these stories and more on "Eye on America" with host Michelle Miller.

Born in a crucial time of need at the start of the pandemic, this organization began with a scrappy operation. Four million meals later, the Seva Collective has continued to grow.

Born in a crucial time of need at the start of the pandemic, this organization began with a scrappy operation. Four million meals later, the Seva Collective has continued to grow, bringing on new volunteers, partnering with food banks, companies and farms, and hosting special toy and clothing drives.

A widower finds a new purpose – in a Publix – after losing his wife. Then, volunteers in Southern California gather to work at a drive-thru that serves nutritious foods for those in need.

Back in March, two officers and a good Samaritan risked their lives to rescue a couple who were trapped in a burning home in Cape Coral, Florida.

A police officer becomes a guardian angel for a little girl struggling at school. A New Jersey toddler goes viral for the way she speaks, bringing joy and laughs to millions. A 7-year-old makes history at the rodeo. Plus, more inspiring stories.

Romance scammers drain billions of dollars from people seeking love, and their tactics have evolved in sinister ways in the online age. CBS News goes inside this devastating epidemic unfolding largely in secret, following the journey of an Illinois woman seeking answers after her mother’s mysterious death.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

Jordyn Zimmerman is autistic and nonspeaking at 29, but she's still making her voice heard.

Victorinox, the maker of the Swiss Army Knife, says it's in the early stage of working on new products without knives.

FTX says that nearly all of its customers will receive the money back they are owed, two years after the cryptocurrency exchange imploded.

A man was convicted in the 2001 murder of Amanda Gonzales, a U.S. Army soldier who was 19 at the time of her death.

Judge Scott McAfee allowed District Attorney Fani Willis to remain on the case involving former President Donald Trump if Nathan Wade resigned, which he did.

Victorinox, the maker of the Swiss Army Knife, says it's in the early stage of working on new products without knives.

FTX says that nearly all of its customers will receive the money back they are owed, two years after the cryptocurrency exchange imploded.

Panera is phasing out a highly caffeinated selection of lemonade beverages that's at the center of several lawsuits.

FDIC Chair Martin Gruenberg is also a focus of the report, which claims he treated staff in a "demeaning and inappropriate manner."

Starbucks, once one of America's most cherished brands, is in a rut. Even long-time former CEO Howard Schultz is worried.

A senior administration official linked the pause to Israel's operation in Rafah.

Judge Scott McAfee allowed District Attorney Fani Willis to remain on the case involving former President Donald Trump if Nathan Wade resigned, which he did.

Three public school district leaders testified before a congressional panel Tuesday on incidents of antisemitism in their schools.

Stormy Daniels was called to the witness stand to testify at former President Donald Trump's trial in New York on Tuesday.

Tens of thousands of migrants are estimated to be waiting in Mexico, in places like Ciudad Juárez where shelter space is limited and the conditions are sometimes dire.

The trend of teens and tweens obsessing over skin care is "at its max," one dermatologist says.

According to a new study, "vehicles are likely important sources of human exposure to potentially harmful" flame retardants.

Panera is phasing out a highly caffeinated selection of lemonade beverages that's at the center of several lawsuits.

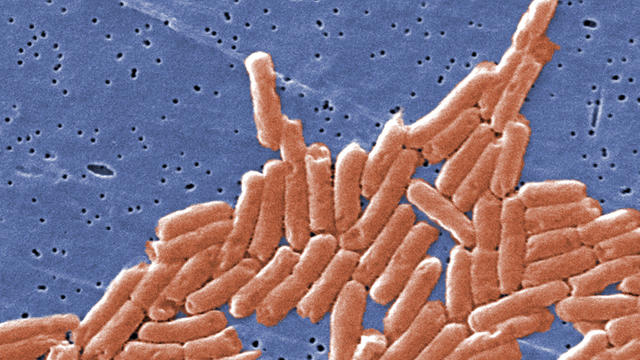

Recall includes yogurt pretzels and other confections sold by retailers such as Dollar General, HyVee, Target and Walmart.

A survey from the American Academy of Dermatology finds more than one-third of adults reported getting a sunburn last year — the highest number since 2020.

A senior administration official linked the pause to Israel's operation in Rafah.

Jerusalem's Hand in Hand school sees Jewish and Arab kids learn together – and they're learning a lot more than just math and science.

Indian police have arrested the parents of a 6-year-old deaf and nonverbal boy who's body was found in a canal with signs of a crocodile attack.

The SS Tilawa was carrying hundreds of passengers and thousands of silver bars when it sank in 1942.

2 days after an apartment building collapsed in South Africa, the search continued for 42 construction workers still believed to be buried in the rubble

As part of AAPI month, "CBS Mornings" partnered with the organization Gold House to celebrate its A 100 list, which recognizes this year's most impactful Asian-Pacific leaders. One of the honorees is actor Hoa Xuande. You may recognize him for his lead role in the HBO show "The Sympathizer." He stars alongside Sandra Oh and Robert Downey Jr. Jo Ling Kent met the rising star, whose unlikely Hollywood journey shows no signs of stopping.

Billboard's Carl Lamarre joins "CBS Mornings" to discuss the heated feud between hip-hop artists Drake and Kendrick Lamar.

As tensions escalate between Kendrick Lamar and Drake, a security guard was critically injured in a shooting outside Drake's Toronto residence. Police are investigating the incident which casts a shadow over the hip-hop community's ongoing disputes.

Gov. Tim Walz on Tuesday signed a ticket transparency bill aimed at protecting music fans when they buy tickets for shows.

Stars were in full bloom at the Met Gala Monday night. The dress code was "Garden of Time." Rachel Smith from "Entertainment Tonight" breaks down fashion's biggest night.

TikTok filed a lawsuit over U.S. legislation that could ban the social media app. It says a new law demanding it sever ties with the Chinese government is unconstitutional and is a free speech issue. However, supporters of the law say it's essential for national security.

Video gamers eagerly awaiting a successor to Nintendo's hit Switch system finally got a clue on when to expect a new device.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

The lawsuit claims that the measure, signed into law by President Biden, is unconstitutional.

Boeing's Starliner was set to make its maiden voyage to the International Space Station, with its first piloted launch Monday night. But the launch, already pushed back following years of delays, was scrubbed with less than two hours to go before liftoff. Mark Strassmanm reports.

In the video, the surface of the sun appears furred with dark yellow material as beams of gold swoop overhead.

The visualization, produced on a NASA supercomputer, allows users to experience flight towards a supermassive black hole.

Boeing's Starliner was set to make its maiden voyage to the International Space Station, with its first piloted launch Monday night. But the launch, already pushed back following years of delays, was scrubbed with less than two hours to go before liftoff. Mark Strassmanm reports.

Reported sightings of giant, toxic, invasive hammerhead flatworms are on the rise in parts of southeastern Canada. Experts say the worms can grow up to 3 feet long and pose a risk to children, pets and other small animals. Peter Ducey, PH.D. and distinguished teaching professor at SUNY Cortland, joins CBS News to discuss the worm.

When NASA added a tiny four-pound helicopter as a stowaway to its Mars 2020 lander, it expected the helicopter to fly five very brief flights in the thin Martian atmosphere. Yet, Ingenuity would far surpass all expectations.

A man was convicted in the 2001 murder of Amanda Gonzales, a U.S. Army soldier who was 19 at the time of her death.

Indian police have arrested the parents of a 6-year-old deaf and nonverbal boy who's body was found in a canal with signs of a crocodile attack.

The worker stabbed a woman and two guards who tried to intervene before being subdued and held in a "shipboard jail," the affidavit says.

A former Mayo Clinic resident accused of fatally poisoning his wife last year may have been identifying as a widower before she even died, a new warrant reveals.

Alexander Louie, 34, told authorities he was not taking his HIV medication so he could purposely infect his partners.

In the video, the surface of the sun appears furred with dark yellow material as beams of gold swoop overhead.

United Launch Alliance decided to replace a suspect valve in the Atlas 5 rocket's upper stage, delaying launch to late next week.

The visualization, produced on a NASA supercomputer, allows users to experience flight towards a supermassive black hole.

Boeing's Starliner space capsule is set for a historic launch Monday night. CBS News space consultant Bill Harwood looks at the long-awaited mission into orbit, and what it could mean for the future of space travel.

Boeing's Starliner was set to make its maiden voyage to the International Space Station, with its first piloted launch Monday night. But the launch, already pushed back following years of delays, was scrubbed with less than two hours to go before liftoff. Mark Strassmanm reports.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

A string of tornadoes this week has hit communities from Oklahoma to Michigan, leaving buildings in ruins and thousands without power across multiple states.

TikTok is suing the U.S. government over a new law that would ban the app nationwide if it doesn't divest from its Chinese parent company ByteDance. In its lawsuit, TikTok points out that many of the lawmakers who passed the law still use the app. CBS News congressional correspondent Scott MacFarlane has more.

Another round of severe weather blew through multiple states Tuesday night, leaving buildings in ruins and tens of thousands without electricity. One town in southwest Michigan was hit with two tornadoes. CBS News correspondent Roxana Saberi has more.

Hundreds of thousands of people across the U.S. are losing their homeowners insurance, with four major companies ending coverage in California due to the growing risk of wildfires. Companies in Florida are canceling policies due to increased hurricane risks. Matthew Eby, the founder and CEO of First Street Foundation, a nonprofit that studies climate risks, joined CBS News to discuss .

This week on "The Dish," "CBS Mornings" explores the increasingly popular Korean-American gastro-pub, Nowon, known for blending American and Asian cuisine.